Get Il Stax-1 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

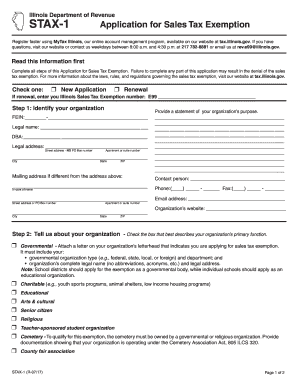

Tips on how to fill out, edit and sign IL STAX-1 online

How to fill out and sign IL STAX-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Declaring your earnings and submitting all necessary tax forms, including IL STAX-1, is the exclusive responsibility of a US citizen.

US Legal Forms simplifies your tax preparation process, making it more efficient and accurate.

Keep your IL STAX-1 stored safely. Ensure all your relevant documents and records are organized while staying mindful of the deadlines and tax regulations established by the IRS. Make it easy with US Legal Forms!

- Access IL STAX-1 in your browser from any device.

- Click to open the fillable PDF document.

- Begin completing the template field by field, following the prompts of the advanced PDF editor’s interface.

- Enter text and numbers with precision.

- Click the Date field to automatically set today’s date or change it manually.

- Use the Signature Wizard to create your own e-signature and sign in just minutes.

- Consult the IRS guidelines if you have any additional questions.

- Click Done to finalize the changes.

- Proceed to print the document, download it, or send it via Email, text, Fax, or USPS without leaving your browser.

How to Modify Get IL STAX-1 2017: Tailor Forms Online

Take advantage of the features offered by the extensive online editor while completing your Get IL STAX-1 2017. Utilize a variety of tools to efficiently fill in the fields and submit the necessary information swiftly.

Creating documents can be lengthy and costly unless you have pre-made editable templates that you can fill in digitally. The simplest method to handle the Get IL STAX-1 2017 is by utilizing our expert and versatile online editing tools. We equip you with all the vital instruments for prompt form completion and enable you to modify your documents to suit any specifications. Additionally, you can annotate the changes and leave messages for other participants.

Here’s what you are capable of doing with your Get IL STAX-1 2017 using our editor:

Handling Get IL STAX-1 2017 with our powerful online editor is the quickest and most efficient method to organize, submit, and disseminate your documents as needed from anywhere. The tool functions from the cloud, enabling access from any location on any internet-enabled device. All forms you create or finish are securely stored in the cloud, allowing you to retrieve them whenever necessary, ensuring you won't lose them. Cease wasting time on manual document filling and eliminate paper; accomplish everything online with minimal effort.

- Complete the empty fields using Text, Cross, Check, Initials, Date, and Sign features.

- Emphasize important elements with a preferred color or underline them.

- Conceal private information with the Blackout tool or simply remove it.

- Upload images to enhance your Get IL STAX-1 2017.

- Swap the original text with the text that meets your requirements.

- Add remarks or sticky notes to inform others about the modifications.

- Insert additional fillable spaces and designate them to specific individuals.

- Secure the template with watermarks, insert dates, and bates numbers.

- Distribute the document in various formats and save it on your device or in the cloud immediately after editing.

Get form

Related links form

To file Illinois sales tax, you will need to complete the correct form, such as the IL STAX-1, based on your sales activity. You can file online or submit your forms via mail. Tools like US Legal Forms make this easier by providing templates and instructions to ensure you meet all requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.