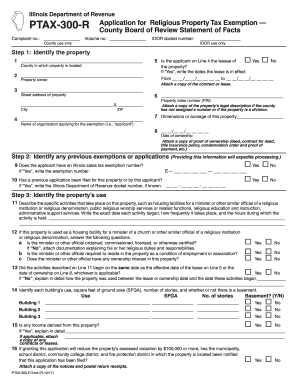

Get Il Dor Ptax-300-r 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IL DoR PTAX-300-R online

How to fill out and sign IL DoR PTAX-300-R online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Verifying your income and submitting all the essential tax documents, including IL DoR PTAX-300-R, is the sole responsibility of a US citizen.

US Legal Forms simplifies your tax filing process, making it more straightforward and accurate.

Safeguard your IL DoR PTAX-300-R. You must ensure that all your relevant documents and information are organized, keeping in mind the deadlines and tax rules established by the IRS. Make it simple with US Legal Forms!

- Access IL DoR PTAX-300-R on your browser from any device.

- Click to open the fillable PDF form.

- Start completing the online template field by field, following the guidance of the advanced PDF editor's interface.

- Accurately input text and figures.

- Click the Date box to automatically set the current date or change it manually.

- Use the Signature Wizard to generate your personalized e-signature and sign in seconds.

- Consult the Internal Revenue Service instructions if you have any remaining inquiries.

- Select Done to finalize the changes.

- Continue to print the document, download it, or share it via email, text message, fax, or USPS without leaving your web browser.

How to modify Get IL DoR PTAX-300-R 2017: personalize forms on the web

Take advantage of the capabilities of the multifaceted online editor while completing your Get IL DoR PTAX-300-R 2017. Utilize the assortment of tools to swiftly fulfill the blanks and provide the necessary information immediately.

Creating paperwork is labor-intensive and costly unless you have pre-prepared fillable forms to complete electronically. The easiest method to handle the Get IL DoR PTAX-300-R 2017 is by using our specialized and multifunctional online editing tools. We offer you all the essential instruments for quick form completion and allow modifications to your templates, tailoring them to any specifications. Additionally, you can annotate changes and leave messages for other individuals involved.

Here’s what you can accomplish with your Get IL DoR PTAX-300-R 2017 in our editor:

Handling the Get IL DoR PTAX-300-R 2017 in our powerful online editor is the fastest and most effective method to organize, submit, and distribute your documents in the manner you desire from any place. The tool functions from the cloud, allowing you to access it from any location on any internet-enabled device. All templates you create or fill out are securely stored in the cloud, ensuring you can always reach them when necessary and be confident they won’t be lost. Stop spending time on manual document completion and eliminate paper; accomplish everything online with minimal effort.

- Complete the blank fields using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize important details with a chosen color or underline them.

- Conceal sensitive information using the Blackout tool or simply remove them.

- Add images to illustrate your Get IL DoR PTAX-300-R 2017.

- Replace the original text with one that meets your needs.

- Leave remarks or sticky notes to discuss updates with others.

- Insert additional fillable sections and designate them to specific recipients.

- Safeguard the document with watermarks, include dates, and bates numbers.

- Distribute the document in various formats and save it on your device or in the cloud after finishing modifications.

Seniors in Illinois can lower their property taxes by applying for exemptions designed specifically for them, such as the Senior Homestead Exemption. This program reduces the taxable value of a qualifying property, thus lowering the overall tax bill. Additionally, seniors might consider appeals if they believe their property has been overvalued. The IL DoR PTAX-300-R serves as a resource for understanding and accessing these benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.