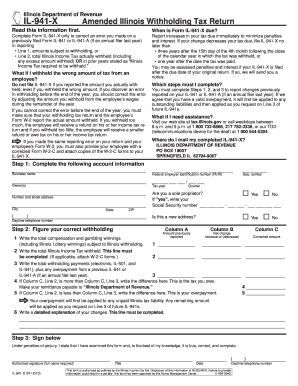

Get Il Dor Il-941-x 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IL DoR IL-941-X online

How to fill out and sign IL DoR IL-941-X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Recording your revenue and presenting all the essential tax documents, including IL DoR IL-941-X, is a US citizen's sole responsibility.

US Legal Forms simplifies your tax management, making it significantly easier and more precise.

Safeguard your IL DoR IL-941-X securely. Ensure all your relevant documents and information are organized while keeping in mind the deadlines and tax laws set by the Internal Revenue Service. Make it easy with US Legal Forms!

- Obtain IL DoR IL-941-X on your device's browser.

- Access the editable PDF file with a single click.

- Start filling out the online template section by section, following the guidance of the advanced PDF editor's interface.

- Diligently input text and figures.

- Click the Date box to automatically insert today's date or change it manually.

- Utilize the Signature Wizard to create your unique e-signature and sign in moments.

- Refer to IRS guidelines if you have any remaining questions.

- Click Done to finalize your changes.

- Continue to print the document, save it, or send it via email, SMS, fax, or USPS without leaving your browser.

How to modify Get IL DoR IL-941-X 2010: personalize forms online

Utilize our robust online document editor to optimize your form preparation. Complete the Get IL DoR IL-941-X 2010, highlight the essential information, and effortlessly make any additional adjustments to its contents.

Filling out documentation digitally not only saves time but also provides the ability to adapt the template to suit your requirements. If you're planning to work on Get IL DoR IL-941-X 2010, think about utilizing our comprehensive online editing resources. Whether you make an error or input the needed data in the incorrect section, you can swiftly amend the document without needing to start over as you would with manual entry.

Moreover, you can emphasize the vital information in your document by showcasing specific elements with colors, underlining, or encircling them.

Our vast online resources are the optimal way to complete and adjust Get IL DoR IL-941-X 2010 to meet your needs. Utilize it to create personal or business documents from anywhere. Access it in a browser, edit your forms, and revisit them at any time in the future - they will all be securely stored in the cloud.

- Access the form in the editor.

- Enter the necessary details in the blank fields using Text, Check, and Cross tools.

- Navigate the document to ensure no required sections are overlooked.

- Encircle some vital details and include a URL if needed.

- Apply the Highlight or Line tools to emphasize the most significant facts.

- Select colors and line thickness to make your document appear professional.

- Remove or obscure information that you wish to keep private.

- Correct any content errors and replace it with the text you require.

- Conclude modifications with the Done option once you verify everything is accurate in the document.

Get form

Related links form

To receive an IRS overpayment refund, you typically need to file Form 843 to claim a refund or request an adjustment. Additionally, keep in mind the importance of the IL DoR IL-941-X for state tax overpayments. Seeking assistance from platforms like uslegalforms can streamline this process and ensure you meet all requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.