Loading

Get Nj Nj-1040 Schedule A B C 2004-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-1040 Schedule A B C online

Filling out the NJ NJ-1040 Schedule A B C online can be straightforward with the right guidance. This comprehensive guide will walk you through each section of the form to ensure that you complete it accurately and efficiently.

Follow the steps to fill out the NJ NJ-1040 Schedule A B C online:

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

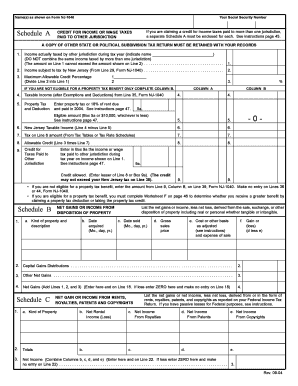

- Begin with Schedule A. Enter your name(s) as shown on Form NJ-1040 at the top of the schedule. Then, provide your Social Security Number.

- For credit for income or wage taxes paid to other jurisdictions, enter the income from Line 1. Ensure that you specify the jurisdiction name and remember that this amount should not exceed Line 2.

- Input the 'Income subject to tax by New Jersey' from Line 29, Form NJ-1040, into Line 2.

- Calculate the maximum allowable credit percentage by dividing Line 1 by Line 2 and enter this on Line 3.

- If you are not eligible for a property tax benefit, complete Column B only, starting with the taxable income from Line 4, which comes from Line 35, Form NJ-1040.

- Enter the property tax or 18% of rent due and paid for the relevant year as indicated in the instructions. Complete both Column A and Column B.

- For Line 5a, determine the eligible amount, which is either Box 5a or $10,000, whichever is less.

- Calculate your New Jersey taxable income by subtracting Line 5 from Line 4, and enter this figure on Line 6.

- Ascertain the tax on the amount listed on Line 6 from the Tax Tables or Tax Rate Schedules, and enter it on Line 7.

- Calculate the allowable credit by multiplying Line 3 by Line 7, and place this in Line 8.

- If you have any income or wage tax paid to other jurisdictions during the tax year on income shown on Line 1, enter it in Box 9a.

- For the credit allowing, enter the lesser of Line 8 or Box 9a. Note that this credit may not exceed your New Jersey tax on Line 38.

- When filling out Schedule B, detail any net gains or income from the disposition of property by listing all relevant sales, acquisitions, and transaction details.

- For Schedule C, report net gains or income from rents, royalties, patents, and copyrights as per your Federal Income Tax Return.

- After completing all relevant sections, review the form for accuracy. Save your changes, download, and print if necessary.

Start filling out the NJ NJ-1040 Schedule A B C online for a smooth filing experience.

Unlike the federal tax code, which allows taxpayers who itemize to deduct charitable contributions to qualifying nonprofits, New Jersey doesn't allow residents to write off such donations from their state income taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.