Loading

Get Il Dor Cpp-1 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR CPP-1 online

This guide provides clear and detailed instructions on filling out the IL DoR CPP-1 Payment Installment Plan Request online. Follow these steps to ensure your application is processed smoothly and efficiently.

Follow the steps to complete the IL DoR CPP-1 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

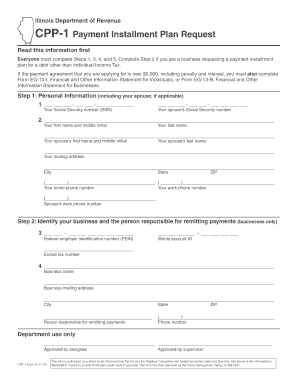

- Provide personal information in Step 1, including your Social Security number, name, mailing address, and contact numbers. If applicable, also include your spouse's information.

- In Step 2, complete this section only if you are a business. Provide your Federal employer identification number (FEIN), Illinois account ID, excise tax number, business name, mailing address, and the responsible person's contact number.

- In Step 3, answer whether all tax returns have been filed. Include the tax periods related to your debt and specify the total unpaid liability. Enter the amount of your good faith downpayment and describe your proposed payment installment plan.

- In Step 4, fill in your financial institution's name, mailing address, and account information, including routing and account numbers. Specify whether the account is checking or savings. Sign to authorize electronic payments.

- In Step 5, read the statement carefully and sign to confirm your agreement to the payment terms and conditions. This signature is necessary to process your request.

- Once all sections are completed, you can save your changes, download, print, or share the form as needed.

Take the first step towards managing your tax liabilities by completing the IL DoR CPP-1 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can submit documents on MyTax Illinois by logging into your account and following the document upload instructions. Make sure you have digital copies of your documents ready for submission. If you need additional guidance while using MyTax in connection with IL DoR CPP-1, uslegalforms offers resources to make this process more straightforward.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.