Get Il Dor Cpp-1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR CPP-1 online

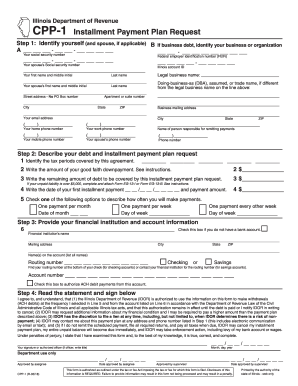

Filling out the Illinois Department of Revenue CPP-1 form for an installment payment plan can seem daunting, but this guide will provide you with clear, step-by-step instructions. Whether you're unfamiliar with tax forms or just need a little assistance, we are here to help you navigate the process smoothly.

Follow the steps to complete your CPP-1 form successfully

- Begin by locating and accessing the form by pressing the ‘Get Form’ button to download it. Ensure you have the form open in a suitable editor for easy completion.

- In Step 1, identify yourself and, if applicable, your spouse. Fill in your social security number and other required personal information, including your legal name and address. If you are reporting business debt, be sure to provide your business's legal name and identification numbers.

- In Step 2, describe your debt by identifying the relevant tax periods covered by your payment plan request. Provide the amount of your good faith down payment, the total remaining debt amount, and indicate the frequency of your intended payments.

- Step 3 requires you to provide information about your financial institution. Enter the name of your bank, your account number, and routing number, and authorize ACH debit payments if necessary.

- Finally, in Step 4, read the statement regarding your agreement, then sign and date the form. Make sure that you understand the obligations and conditions of the payment plan before submitting your application.

- After filling out the form, you can save your changes, download a copy for your records, print it, or share it as required. Ensure that you submit your completed form to the appropriate department as outlined in the instructions.

Complete your IL DoR CPP-1 form online today for a structured and manageable payment plan.

Get form

Related links form

In Illinois, individuals and businesses that own personal property are subject to the Personal Property Tax Replacement Income Tax. This tax aims to replace revenue lost due to changes in property tax legislation. If you seek assistance in understanding your tax situation, uslegalforms offers resources to help you navigate your responsibilities effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.