Loading

Get Id St-101 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID ST-101 online

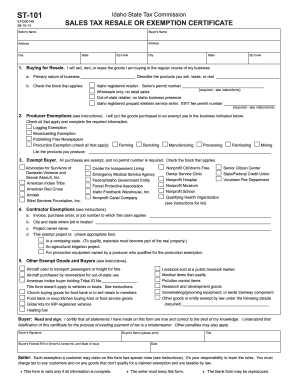

The ID ST-101 form is a sales tax resale or exemption certificate used in Idaho. This guide will provide you with step-by-step instructions on how to accurately complete the form online, ensuring you understand each section and field.

Follow the steps to effectively complete the ID ST-101 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the necessary fields for completion.

- Input the seller's name in the designated field. This identifies the individual or business selling the goods.

- Next, enter the buyer's name, ensuring it matches the legal name of the person or entity purchasing the goods.

- Fill in the address fields for both the seller and buyer. This includes the street address, city, state, and zip code.

- In section 1, select the box indicating you are buying for resale and provide a description of the products you sell, lease, or rent, as well as your Idaho seller's permit number if applicable.

- Complete section 2 if claiming producer exemptions by checking the relevant boxes for exemptions like logging or broadcasting and listing products produced as required.

- For purchases that qualify as exempt, report your status in section 3 by checking the block that applies to your situation.

- If your claim involves contracting work, fill out section 4 with necessary details such as the job number and project owner name.

- In section 5, indicate any other exempt goods or buyers if applicable by checking the appropriate box and providing required details.

- Finally, read and sign the certification statement at the bottom, providing your federal EIN or driver's license number, name, title, and date before submitting.

- Once completed, save changes, download, print, or share the form as needed.

Start filling out your ID ST-101 form online today to ensure proper completion and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The ST-101 form in Idaho is used to claim various tax exemptions, including property tax exemptions available to qualifying homeowners. This form helps streamline your application for benefits that can reduce your tax liabilities. Utilizing the ID ST-101 effectively can provide significant financial relief, so ensure you understand its requirements and complete it accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.