Loading

Get Id Dol Tax020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID DOL Tax020 online

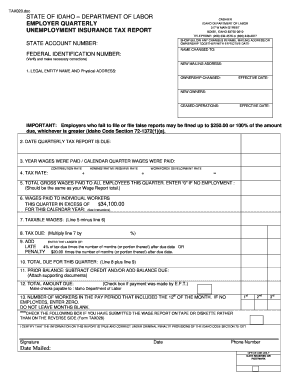

The ID DOL Tax020 is a crucial document for employers in Idaho, serving as the employer quarterly unemployment insurance tax report. Accurate completion of this form helps ensure compliance with state regulations and avoids penalties.

Follow the steps to properly fill out the ID DOL Tax020 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your state account number in the field indicated. This number is crucial for identification purposes.

- If there are any changes in name or ownership, please provide the new name and effective date in the designated fields.

- Fill in the federal identification number, ensuring it is accurate and matches your records.

- Provide your new mailing address, if applicable. This ensures that all correspondence will reach you.

- Indicate the legal entity name and physical address where your business operates.

- Complete the section on ownership changes, including the effective date and information about new owners, if relevant.

- Enter the date the quarterly tax report is due, along with the year and calendar quarter during which wages were paid.

- Document the gross wages paid to all employees this quarter. If there were no employees, you should enter ‘0’.

- Complete the wages paid to individual workers in excess of $34,100. This figure is needed for the tax calculation.

- Calculate the taxable wages by subtracting the excess wages from the total gross wages.

- Determine the tax due by multiplying the taxable wages by the applicable tax rate.

- Calculate any late penalties, which could be based on the tax due and the number of months it is late.

- Add the total due for the quarter by combining the tax due and any penalties calculated.

- If there are any prior balances, subtract credits and add balances due to arrive at the total amount due.

- Check the box if payment was made electronically, and ensure to make any relevant corrections.

- Lastly, provide the number of workers employed during the pay period that included the 12th of the month. Enter zero if no employees were present.

- Review all entries for accuracy before proceeding to save, download, print, or share the completed form.

Complete your ID DOL Tax020 online today to ensure compliance and avoid penalties.

Related links form

Idaho unemployment tax rates can vary based on your business's experience rating. Typically, this rate applies to the first $45,000 of an employee's wages. To find your specific rate and ensure compliance, utilize resources like ID DOL Tax020 to gain insight and maximize your financial planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.