Get Ca Cdtfa-735 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CDTFA-735 online

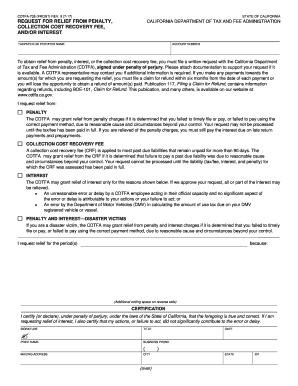

The CA CDTFA-735 form is essential for individuals seeking relief from penalty, collection cost recovery fees, and/or interest imposed by the California Department of Tax and Fee Administration. This guide provides clear, step-by-step instructions on how to complete this form online accurately and efficiently.

Follow the steps to ensure a smooth submission of your request.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer or feepayer name in the designated field.

- Select the type of relief you are requesting by checking the appropriate boxes for penalty, collection cost recovery fee, and/or interest.

- If applicable, fill out the period(s) for which you are requesting relief and provide an explanation in the 'because' section.

- Complete the certification section by confirming that the information provided is true and correct. Sign in the designated area on the form.

- Include your title, printed name, business phone, mailing address, city, state, and zip code.

- Ensure all sections are completed accurately. Review your information for any errors or omissions before proceeding.

- Save changes to your completed form, and utilize the options to download, print, or share the form as needed.

Take action now and complete your CA CDTFA-735 form online for a smoother tax relief experience.

Get form

Related links form

Sales tax audits in California can be triggered by irregularities in sales reporting, such as unreported income or excessive deductions. Additionally, frequent adjustments in sales tax returns can raise concerns. To safeguard against audits, businesses should ensure accurate record-keeping and compliance through CA CDTFA-735, which outlines clear guidelines for proper reporting.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.