Get Hi Schedule K-1 Form N-35 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI Schedule K-1 Form N-35 online

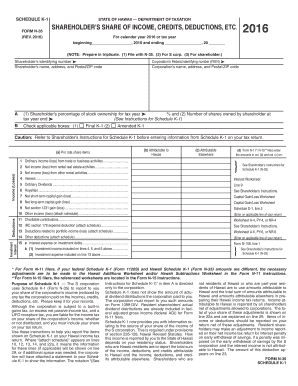

The HI Schedule K-1 Form N-35 is an essential document used by S corporations in Hawaii to report shareholders' share of income, credits, deductions, and other relevant tax information. This guide will provide you with clear, step-by-step instructions on how to fill out the form online, ensuring a smooth filing process.

Follow the steps to complete the HI Schedule K-1 Form N-35 efficiently.

- Click ‘Get Form’ button to access the HI Schedule K-1 Form N-35 and open it in your preferred web-based document editor.

- Fill in the section for the shareholder’s identifying number, followed by their name, address, and postal/ZIP code accurately.

- Enter the corporation’s federal identifying number (FEIN) and the corporation's name, address, and postal/ZIP code.

- Provide the shareholder’s percentage of stock ownership for the tax year and the number of shares owned by the shareholder at the end of the tax year.

- Check the applicable boxes indicating whether this is a final K-1 or an amended K-1.

- Carefully fill out the income and loss sections, providing amounts in the relevant categories, such as ordinary income, net income from rental activities, interest, dividends, and capital gains, using the attached schedules where applicable.

- Complete the credits section, providing any pro-rata share items and indicating amounts attributable to Hawaii and elsewhere for various tax credits listed.

- If applicable, include any required supplemental information or adjustments that need to be reported separately.

- Review all the information filled in on the form for accuracy before you proceed to save changes.

- Once all information is confirmed, download, print, or share the completed form as necessary.

Begin completing your HI Schedule K-1 Form N-35 online today for a hassle-free filing experience!

Get form

Related links form

1 inheritance tax form is a document that reports income generated by an inherited trust or estate. It details the applicable income that beneficiaries must report on their taxes. Each beneficiary receives a K1 to understand their share of income. To ensure proper filing, use the HI Schedule K1 Form N35 for your inheritance income.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.