Loading

Get Hi Schedule K-1 Form N-35 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI Schedule K-1 Form N-35 online

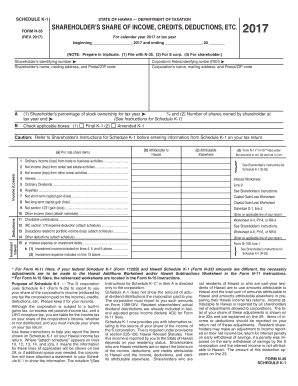

Filling out the HI Schedule K-1 Form N-35 online can streamline the process of reporting your share of income, deductions, and credits from an S corporation. This guide provides step-by-step instructions to help you accurately complete this form with ease.

Follow the steps to successfully complete the HI Schedule K-1 Form N-35.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the shareholder's identifying number and their full name, along with the mailing address and Postal/ZIP code.

- Next, input the corporation's Federal identifying number (FEIN) and the corporation's name, including its mailing address and Postal/ZIP code.

- In section A, provide the shareholder’s percentage of stock ownership for the tax year and the number of shares owned by the shareholder at the tax year end.

- Check the appropriate boxes in section B to indicate if this is a final or amended K-1.

- Proceed to report the ordinary income (loss) and various income items from lines 1 through 20, ensuring to attach any necessary schedules as indicated.

- Complete section C regarding any credits applicable and make sure to detail amounts attributable to Hawaii and elsewhere as required.

- Finally, ensure that all information is filled out accurately. Save changes, download, print, or share the completed form as needed.

Start completing your HI Schedule K-1 Form N-35 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

IRS tax forms can usually be picked up at post offices, libraries, and certain government offices. However, to ensure you have the latest versions, including the HI Schedule K-1 Form N-35, it’s advisable to visit the IRS website or use uslegalforms for quicker access and comprehensive support.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.