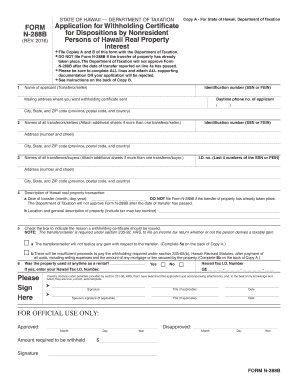

Get Hi N-288b 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign HI N-288B online

How to fill out and sign HI N-288B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Logging your income and declaring all the essential tax documents, including HI N-288B, is the exclusive responsibility of a US citizen.

US Legal Forms simplifies your tax management, making it clearer and more precise.

Store your HI N-288B securely. Ensure that all your accurate documents and records are organized while keeping in mind the deadlines and tax regulations set by the Internal Revenue Service. Simplify it with US Legal Forms!

- Obtain HI N-288B on your browser from any device.

- Access the fillable PDF file with a single click.

- Begin filling out the template field by field, following the prompts of the advanced PDF editor’s interface.

- Precisely enter textual information and figures.

- Click the Date box to automatically insert the current date or modify it manually.

- Utilize the Signature Wizard to create your personal e-signature and sign in moments.

- Refer to Internal Revenue Service guidelines if you still have uncertainties.

- Hit Done to save the changes.

- Proceed to print the document, download it, or share it via Email, text messaging, Fax, or USPS without leaving your web browser.

How to modify Get HI N-288B 2016: personalize forms online

Locate the appropriate Get HI N-288B 2016 template and modify it immediately. Streamline your documentation with an intelligent document modification solution for online forms.

Your routine tasks involving documentation and forms can become more efficient when everything you require is centralized in one location. For example, you can discover, retrieve, and alter Get HI N-288B 2016 in a single browser window. If you require a particular Get HI N-288B 2016, it is straightforward to locate it with the aid of the intelligent search engine and access it without delay. There is no need to download it or look for an external editor to change it and incorporate your details. All the tools for productive work come in one comprehensive solution.

This modification solution enables you to alter, complete, and sign your Get HI N-288B 2016 form right away. When you find an appropriate template, click on it to enter the modification mode. Once the form is opened in the editor, you have all the essential tools readily available. Filling in the designated fields is simple, and you can eliminate them if necessary using a straightforward but versatile toolbar. Apply all the changes immediately, and sign the document without closing the tab by merely clicking the signature space. Afterward, you can share or print your document if required.

Make additional custom changes with available instruments.

Explore new possibilities in streamlined and effortless paperwork. Find the Get HI N-288B 2016 you require in minutes and complete it within the same tab. Clear the chaos in your documentation once and for all with the help of online forms.

- Annotate your document with the Sticky note feature by placing a note at any location within the document.

- Add needed visual components, if necessary, with the Circle, Check, or Cross tools.

- Change or insert text anywhere in the document using Texts and Text box options. Incorporate content with the Initials or Date tool.

- Alter the template text using the Highlight, Blackout, or Erase tools.

- Introduce custom visual elements with the Arrow, Line, or Draw tools.

Get form

While mailing your state tax return is an option, e-filing is increasingly popular and can simplify the process. If you choose to mail your return, ensure that you follow the guidelines provided for submission, particularly concerning the HI N-288B. Each approach has benefits, so choose the method that best aligns with your preferences and needs.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.