Loading

Get Hi Dot P-64a 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT P-64A online

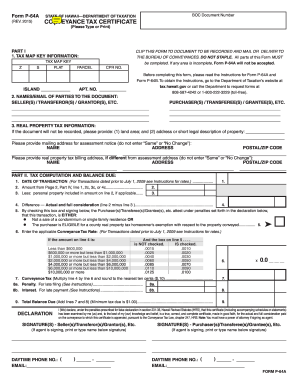

Filling out the HI DoT P-64A form online can streamline the process of submitting your conveyance tax certificate. Whether you are a first-time user or familiar with these kinds of documents, this guide will provide clear instructions to ensure accuracy and completeness.

Follow the steps to successfully complete your HI DoT P-64A form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in Part I with tax map key information, including the island, parcel number, and any applicable apartment number. Ensure all sections are complete, as incomplete submissions will not be accepted.

- Provide the names and email addresses of all parties involved in the transaction, including sellers and purchasers.

- Enter real property tax information, including mailing and billing addresses. Do not use 'Same' or 'No Change.'

- In Part II, specify the date of transaction and the relevant amounts as per the guidelines provided in the instructions.

- Calculate the conveyance tax rate applicable to your transaction based on the consideration amount. Select the correct box indicating whether the transaction qualifies for a homeowner's exemption.

- Complete the necessary calculations for conveyance tax, penalties for late filing, and interest for late payment, if applicable.

- Fill out Part III by entering all amounts paid or required for the real property interest conveyed, ensuring every applicable cash or non-cash form of consideration is accounted.

- In Part IV, provide details about the type of transfer taking place, and enter the totals of actual consideration where required.

- Review all entries for accuracy. Save changes, and then download, print, or share the completed form as needed.

Complete your HI DoT P-64A form online today for a smoother process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Hawaii Form N-15 should be mailed to the Department of Taxation in Honolulu. Make sure to check the latest instructions on the Hawaii Department of Taxation’s website for the most accurate mailing address and any additional requirements. Completing forms like the HI DoT P-64A beforehand will prepare you for this submission process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.