Loading

Get Ok 511ef 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK 511EF online

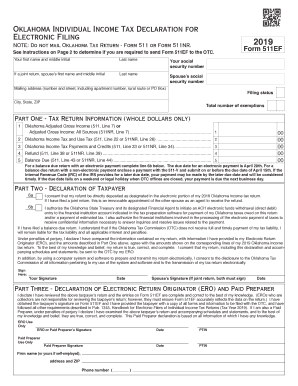

The OK 511EF is a crucial form for filing your individual income tax electronically in Oklahoma. This guide provides clear, step-by-step instructions to ensure that users, regardless of their legal experience, can successfully complete the form online.

Follow the steps to fill out the OK 511EF accurately and efficiently.

- Press the ‘Get Form’ button to access the form, initiating the process to open it in an online editor.

- Begin by entering your first name and middle initial, followed by your last name.

- Input your social security number to ensure proper identification.

- If filing jointly, also enter your spouse’s first name and middle initial along with their last name and social security number.

- Next, provide your mailing address, including the number and street, apartment number (if applicable), city, state, and ZIP code.

- Select your filing status and indicate the total number of exemptions you claim.

- In Part One - Tax Return Information, complete the sections for Oklahoma Adjusted Gross Income, Oklahoma Income Tax and Use Tax, Oklahoma Income Tax Payments and Credits, Balance Due, and Refund, providing values as whole dollars.

- If applicable, in Part Two - Declaration of Taxpayer, consent to the direct deposit of your refund and authorize any necessary electronic funds withdrawal for payments.

- Sign and date the form. If filing jointly, ensure both partners provide their signatures and dates.

- In Part Three - Declaration of Electronic Return Originator (ERO) and Paid Preparer, if you are using a preparer, ensure they provide their signature and relevant details.

- After completing all sections, you will have the option to save changes, download the form, print it, or share it as needed.

Complete your OK 511EF form online today to streamline your tax filing process.

Each partner having Oklahoma source income sufficient to make a return, shall make such return as required by law. Partnerships filing Federal Form 1065-B will file Form 514. The taxable year and method of accounting shall be the same as the taxable year and method of accounting used for federal income tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.