Loading

Get Mn Dor Form St30 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Form ST30 online

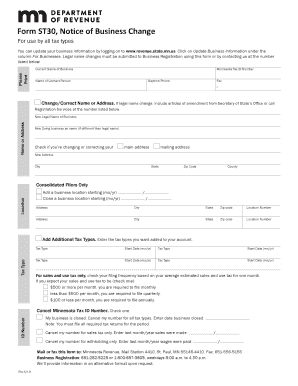

This guide provides a clear and comprehensive overview of how to fill out the Minnesota Department of Revenue Form ST30 online. The form is designed for users to update their business information efficiently and accurately.

Follow the steps to complete the MN DoR Form ST30 online.

- Click the ‘Get Form’ button to access the MN DoR Form ST30 and open it in the digital editing interface.

- Enter the current name of your business and the Minnesota Tax ID number in the appropriate fields.

- Provide the name of the contact person along with their daytime phone number and fax number.

- Indicate whether you are changing or correcting the name or address. If you are submitting a legal name change, include articles of amendment from the Secretary of State’s Office.

- For a new legal name of business, fill in the new legal name and, if applicable, the new doing business as name.

- Check the boxes to specify whether you are changing your main address or mailing address. Then, fill out the new address details, including city, state, zip code, and county.

- If you are a consolidated filer, indicate any business locations being added or closed, specifying the start date. Include addresses and location numbers for each business location.

- Add any additional tax types you want to include in your account. Enter the tax type and start date for each entry.

- For sales and use tax only, select your filing frequency based on your average estimated sales and use tax for one month.

- If cancelling your Minnesota Tax ID number, check the appropriate box and provide the necessary closure information. Include specific dates as requested.

- Once all information is completed, review the form for accuracy. You can then save changes, download a copy, print it, or share the form as needed.

Start filling out your MN DoR Form ST30 online today!

The 2023 tax year (taxes filed in 2024) has seven tax rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%, the same as in tax year 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.