Loading

Get Mn Dor Form Rev185b 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Form REV185b online

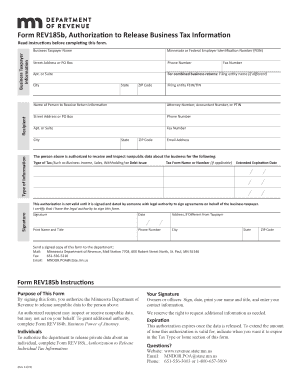

Filling out the MN DoR Form REV185b online can be straightforward if you follow the proper steps. This guide provides clear, detailed instructions to help you complete the Authorization to Release Business Tax Information form efficiently.

Follow the steps to successfully complete the MN DoR Form REV185b

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Fill in the 'Business Taxpayer Name' field with the legal name of your business. Make sure it matches the name on your official tax documents.

- Enter your Minnesota or Federal Employer Identification Number (FEIN) in the appropriate field. This number is essential for the identification of your business.

- Provide a complete street address or PO Box number for your business under the 'Street Address or PO Box' field. Ensure that all details are accurate.

- Include the phone number associated with your business in the designated field to facilitate communication.

- If applicable, add your apartment or suite number in the 'Apt. or Suite' section.

- For combined business returns, fill in the 'Filing entity name' if it is different from the Business Taxpayer Name.

- Input your city, and ensure to enter the ZIP Code accurately.

- Indicate the name of the person authorized to receive return information under 'Name of Person to Receive Return Information'.

- Fill in the Attorney Number, Accountant Number, or PTIN for the authorized person, if relevant.

- Repeat the address fields for the authorized person including street address, phone number, city, state, and ZIP Code.

- Specify the type of information being requested in the 'Type of Information' section.

- Mention the type of tax or debt issue and, if applicable, the tax form name or number.

- Set an extended expiration date for the authorization for clarity on how long it remains valid.

- Ensure that the form is signed and dated by an individual who has legal authority to sign on behalf of the business taxpayer. This is essential for the authorization to be valid.

- After filling in all necessary information, confirm accuracy, then save changes, download, or print your completed form as needed to submit.

Complete your documentation online today to ensure smooth processing.

You can file your Minnesota Individual Income Tax return electronically or by mail. The due date for 2022 returns is April 18, 2023. You may qualify for free electronic filing if your income is $73,000 or less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.