Loading

Get Co D11 Substitute W-9 And New Vendor Setup Form 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO D11 Substitute W-9 And New Vendor Setup Form online

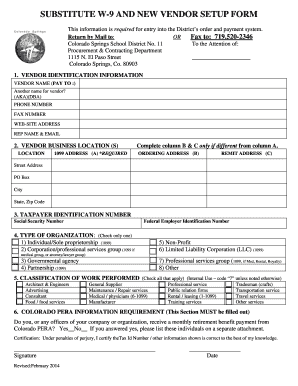

The CO D11 Substitute W-9 And New Vendor Setup Form is essential for individuals and organizations looking to register as a vendor with the Colorado Springs School District. This guide will walk you through each section of the form, providing clear and user-friendly instructions to complete it online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the Vendor Identification Information section, enter the vendor name in the 'Vendor name (pay to)' field. If the vendor has alternative names, include them in the 'Another name for vendor? (aka)(DBA)' field, along with the contact number, fax number, website address, representative name, and their email.

- Complete the Vendor Business Location(s) section by providing the location address. Input the 1099 address in column A, making sure to fill in the ordering and remit addresses only if they differ from this primary address.

- In the Taxpayer Identification Number section, include either the Social Security Number or the Federal Employer Identification Number, depending on the vendor's classification.

- Select the type of organization from the provided options. Check only one box that best represents the vendor's classification, such as Individual/Sole Proprietorship, Corporation, or Non-Profit.

- In the Classification of Work Performed section, mark all applicable types of services offered by the vendor. This helps the district categorize the vendor's capabilities.

- Complete the Colorado PERA Information Requirement by indicating whether any officers of the company receive a monthly retirement benefit payment from Colorado PERA. If yes, list those individuals on a separate attachment.

- Finally, sign and date the form in the designated area to certify that the information provided is accurate. Ensure you save any changes you’ve made before proceeding.

- After filling out the form, you can download, print, or share it as needed. Review all entries to ensure completeness and accuracy.

Complete your forms online today for a streamlined vendor registration process.

The short answer is: always. We'll review the exceptions to this rule, but overall, businesses should always request their vendors to fill out a W9 form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.