Get Hi Dot N-848 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-848 online

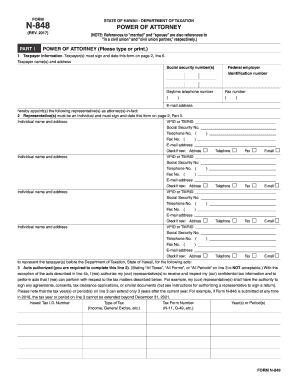

Filling out the HI DoT N-848 form is an essential step for taxpayers in Hawaii who wish to authorize a representative for tax matters. This guide provides a clear and detailed approach to completing this form online, ensuring that users understand each section and requirement.

Follow the steps to complete the HI DoT N-848 form online.

- Press the ‘Get Form’ button to access the HI DoT N-848 online form and open it in your selected editor.

- In Part I, provide the taxpayer information. Include names, social security numbers, and contact details such as a daytime telephone number and email address. Ensure all information is accurate as it identifies the taxpayer.

- Name and provide the required details of the representative(s) in the designated fields. Each representative must be an individual and must sign Part II on page 2.

- On line 3, specify the acts authorized by providing detailed descriptions of the tax matters you wish the representative to handle. Avoid general phrases like 'All Taxes' or 'All Forms'.

- Complete line 4a by checking any additional acts authorized, such as authorizing disclosure to third parties or substituting representatives if needed.

- If applicable, list specific acts that are not authorized on line 4b, ensuring your instructions are clear concerning any limitations placed on the representative's authority.

- In Part I, the taxpayer(s) must sign and date the form. If a joint return is involved, both individuals must sign.

- In Part II, every representative must sign, date, and print their name in the order listed in Part I, line 2.

- Review the completed form for accuracy. Once you have confirmed all information is correct, you can save changes, download, print, or share the completed form as necessary.

Complete your HI DoT N-848 form online today for a hassle-free representation process.

Get form

The primary difference between a power of attorney and a durable power of attorney lies in the duration of authority. A standard power of attorney typically becomes void if the principal is incapacitated, whereas a durable power of attorney remains in effect despite incapacity. This distinction is important when it comes to long-term planning, especially as outlined in the HI DoT N-848. Understanding these differences can help you make informed decisions about your legal powers.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.