Loading

Get Hi Dot N-30 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-30 online

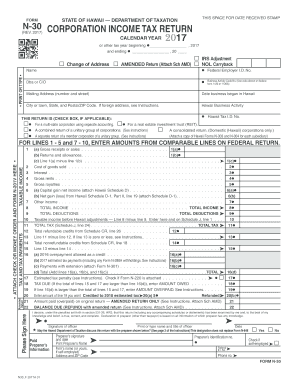

Filing the HI DoT N-30, or Corporation Income Tax Return, online requires careful attention to detail. This guide will walk you through each section of the form, ensuring you understand the requirements and process involved.

Follow the steps to complete the HI DoT N-30 form with ease.

- Press the ‘Get Form’ button to access the form and open it in your preferred format.

- Begin by filling out the basic information: Enter the federal employer identification number and business activity code. You must also include your business address, including city, state, and postal code.

- Indicate if your return is for an amended return, includes an IRS adjustment, or involves a change of address by checking the appropriate boxes.

- Complete the income section of the form by entering gross receipts or sales, returns and allowances, and calculating the net amount. Ensure accuracy as these figures will determine your taxable income.

- Proceed to enter deductions and calculate your total income. Be sure to input information from your federal return as required.

- After calculating your total tax, enter any refundable credits, and determine the tax due or overpaid.

- Sign the document in the designated area, ensuring all fields are accurately completed, including preparer's information if applicable.

- Once all parts of the form are filled out, you can save your changes, download the document, print for your records, or share it as needed.

Complete the HI DoT N-30 online today to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The simplest way to do your tax return is to utilize an online service that walks you through the necessary steps. Platforms such as USLegalForms offer easy access to forms like the HI DoT N-30, streamlined processes, and customer support. By choosing the right tools, you’ll find that managing your tax return is much more straightforward.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.