Loading

Get Hi Dot N-288c 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-288C online

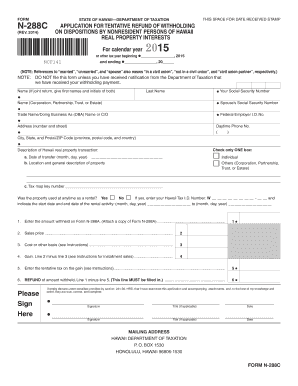

Filling out the HI DoT N-288C form can be straightforward if you follow the proper guidelines. This document is essential for applying for a tentative refund of withholding for dispositions by nonresident persons of Hawaii real property interests.

Follow the steps to complete the HI DoT N-288C online.

- Press the ‘Get Form’ button to access the HI DoT N-288C form and open it in the online editor.

- Begin by entering the tax year at the top of the form. If it is not a calendar year, indicate the relevant year.

- Provide the name and social security number (or federal employer identification number) of the transferor/seller. Ensure this matches the information from Form N-288A.

- In the property description section, provide details about the Hawaii real property transaction, including location and a general description.

- Indicate whether the property was used as a rental. If yes, enter your Hawaii Tax I.D. Number and the rental activity start and end dates.

- Enter the amount withheld as shown on Form N-288A.

- List the sales price of the property.

- Calculate and enter the cost or other basis of the property, considering any improvements and depreciation.

- Calculate the gain by subtracting the cost or basis from the sales price.

- Determine the tentative tax on the gain based on the applicable tax rate schedule.

- Compute the refund amount by subtracting the tentative tax from the amount withheld. This line must be filled in.

- Sign the form and ensure all required signatures are obtained, including from your spouse if filing jointly.

- Review the completed form to ensure all sections are filled out correctly. Save your changes, and then download, print, or share the completed form as required.

Complete your HI DoT N-288C application online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Your withholding allowance depends on your personal situation, including the number of dependents and your total tax obligations. Use the HI DoT N-288C to help determine the appropriate number of allowances to claim. This ensures that you withhold the correct amount of tax from your earnings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.