Loading

Get Ct Ifta-101-mn 2008-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT IFTA-101-MN online

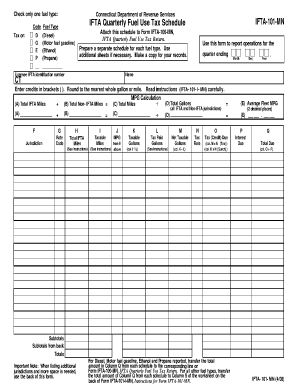

The CT IFTA-101-MN form is essential for reporting fuel usage and calculating tax obligations for interstate operations in Connecticut. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately online.

Follow the steps to complete your CT IFTA-101-MN form online.

- Press the 'Get Form' button to access the CT IFTA-101-MN online and open it in your document editor.

- Begin by selecting your fuel type from the provided options: Diesel (D), Motor fuel gasoline (G), Ethanol (E), or Propane (P). Ensure that you check only one fuel type for this schedule.

- Enter your licensee IFTA identification number, and specify the quarter ending date including the month, day, and year.

- Complete the personal details by filling in your name and the state of Connecticut (CT).

- Input the total IFTA miles and non-IFTA miles, and calculate the total miles by adding these two figures.

- Record the total gallons used, then calculate the average fleet miles per gallon (MPG) using the provided formula.

- Fill in the jurisdiction details, including the rate code and total IFTA miles in the provided columns. Ensure to calculate taxable miles, MPG, taxable gallons, tax paid gallons, net taxable gallons, tax rate, and tax credit due.

- Subtotals from the back of the form need to be transferred to the front. Follow instructions carefully to ensure accurate entries in the total due.

- Verify all entries for accuracy, and once confirmed, you can save changes, download, print, or share the completed form.

Start completing your CT IFTA-101-MN form online today for easy and efficient management of your tax reporting.

In order to receive an IFTA License you will need to submit a IFTA License Application from the Mississippi Department of Revenue, Petroleum Tax Division. Currently there is no charge for an IFTA sticker application or IFTA decals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.