Loading

Get Hi Dot N-20 - Schedule K-1 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-20 - Schedule K-1 online

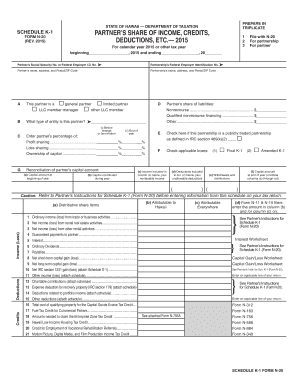

The HI DoT N-20 - Schedule K-1 is an essential form for reporting a partner’s share of income, credits, and deductions from a partnership. This guide will assist you in completing the form efficiently and accurately online.

Follow the steps to complete the HI DoT N-20 - Schedule K-1 online.

- Click 'Get Form' button to acquire the form and open it in your online editor.

- Begin by entering the calendar year or other tax year for which the form is applicable in the designated field. Ensure that you specify both the start and end dates correctly.

- Fill in the partner’s Social Security Number or Federal Employer Identification Number in the appropriate box.

- Next, provide the partnership’s Federal Employer Identification Number.

- Input the partner’s name, address, and Postal/ZIP code followed by the partnership’s name, address, and Postal/ZIP code.

- Indicate the partner's role by checking the appropriate box: general partner, limited partner, LLC member-manager, or other LLC member.

- Specify the type of entity for the partner by selecting from the options provided.

- Enter the partner’s percentage of profit sharing, loss sharing, and ownership of capital in the designated fields.

- Complete the reconciliation of the partner’s capital account by filling in the capital account at the beginning of the year and any capital contributed during the year.

- Detail the partner’s share of liabilities, ensuring to categorize them correctly under nonrecourse, qualified nonrecourse financing, or other.

- If applicable, check the box indicating whether the partnership is a publicly traded partnership.

- Proceed to enter the distributive share items, ensuring to include the income, deductions, and relevant credits under the applicable columns.

- Follow instructions on how to report any credits or deductions pertinent to the partnership and ensure to attach any necessary schedules.

- At the conclusion of your entries, review the form for accuracy and completeness before saving your changes.

- Once satisfied with the completed form, you may download, print, or share it as required.

Complete your HI DoT N-20 - Schedule K-1 online for an efficient filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Code N in Box 12 refers to certain unrecaptured section 1250 income attributed to real estate investment. It’s essential to report this accurately to avoid miscalculations in your taxes. Using the HI DoT N-20 - Schedule K-1 can simplify this process, ensuring you don’t overlook important details.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.