Loading

Get Hi Dot N-139 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-139 online

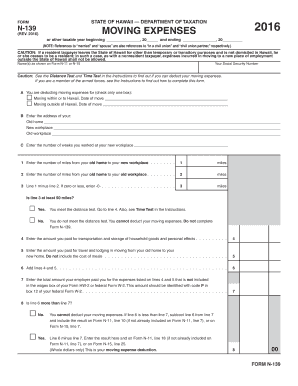

The HI DoT N-139 form is essential for individuals seeking to deduct moving expenses related to their new workplace. This guide provides step-by-step instructions to help users fill out the form accurately and efficiently in an online format.

Follow the steps to complete the HI DoT N-139 form online.

- Press the ‘Get Form’ button to access the N-139 form and open it in your preferred online editor.

- Complete the section regarding your name(s) as shown on Form N-11 or N-15 and provide your social security number.

- Indicate whether you are deducting moving expenses for a move within or to Hawaii or moving outside of Hawaii by checking the appropriate box. Specify the date of your move.

- Provide the addresses of your old home, new workplace, and old workplace in the designated fields.

- Enter the number of weeks you have worked at your new workplace as requested.

- Input the number of miles from your old home to your new workplace, followed by the number of miles from your old home to your old workplace.

- Calculate the difference between the two mileages and input the result. If the result is zero or negative, enter -0-. Confirm if this result meets the 50-mile distance test.

- Provide the total amount you incurred for transportation and storage of household goods and personal effects.

- Enter the amount spent on travel and lodging while moving from your old home to your new home, excluding meals.

- Sum the amounts from lines 4 and 5 and enter the total.

- Include any reimbursements received from your employer for moving expenses as indicated. Check if line 6 exceeds line 7 and follow the subsequent instructions accordingly.

- Finally, after verifying all entries, users can save changes, download, print, or share the completed form.

Begin your journey to complete the HI DoT N-139 online and ensure your moving expenses are accurately deducted!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The nonresident property tax in Hawaii is typically calculated based on the assessed value of property owned by individuals who do not reside in the state. Rates may vary by county, so understanding the local regulations is crucial for property owners. Nonresidents should stay informed about these taxes to avoid surprises. Uslegalforms can provide guidance on navigating these requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.