Loading

Get Hi Dot Hw-14 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT HW-14 online

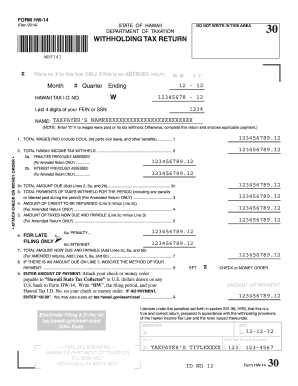

This guide provides clear and concise instructions on correctly completing the HI DoT HW-14 form online. Whether you are a first-time user or need a refresher, this guide will support you in accurately providing the required information.

Follow the steps to efficiently complete your HI DoT HW-14 form online.

- Click ‘Get Form’ button to access the HI DoT HW-14 form and open it in your preferred online editor.

- Indicate whether this is an amended return by placing an ‘X’ in the designated box if applicable. If not, leave it blank.

- Enter the month and year for the quarter you are reporting in the appropriate sections.

- Input your Hawaii Tax I.D. number in the provided field, ensuring it is accurate.

- Provide your name as it should appear on the form. Make sure to follow instructions regarding entering '0' if there were no wages paid or taxes withheld.

- Complete the total wages paid, which includes all relevant wages, benefits, and other amounts as noted on the form.

- Fill out the total Hawaii income tax withheld in the specified field.

- If filing an amended return, enter any penalties or interest previously assessed in the corresponding areas.

- Calculate the total amount due by following the lines indicated on the form, particularly for any amended return entries.

- Indicate the payment method for any amounts due, ensuring to follow the instructions closely.

- Review all entered information for accuracy, then save your changes, download, or print the completed form as required.

Complete your HI DoT HW-14 online today to ensure accurate tax reporting and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, businesses operating in Hawaii typically need a General Excise (GE) license. This license allows you to conduct a wide range of business activities while complying with state tax requirements. Utilizing the resources available on the uslegalforms platform can guide you through the application process for obtaining your GE license and managing your tax responsibilities effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.