Get Hi Dot Gew-ta-rv-5 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

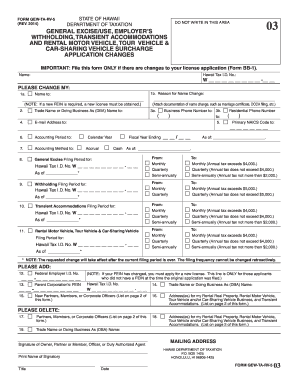

Tips on how to fill out, edit and sign HI DoT GEW-TA-RV-5 online

How to fill out and sign HI DoT GEW-TA-RV-5 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and submitting all the essential tax documents, including HI DoT GEW-TA-RV-5, is the unique duty of a US citizen.

US Legal Forms simplifies your tax management, making it clearer and more effective.

Store your HI DoT GEW-TA-RV-5 securely. Ensure that all your accurate documents and information are in place while being mindful of the deadlines and tax regulations established by the IRS. Simplify the process with US Legal Forms!

- Obtain HI DoT GEW-TA-RV-5 through your web browser on your device.

- Access the editable PDF file with a click.

- Begin filling out the template box by box, guided by the advanced PDF editor's interface.

- Carefully enter text and numbers.

- Click the Date field to auto-fill the current date or change it manually.

- Utilize the Signature Wizard to create your unique e-signature and sign in moments.

- Refer to the Internal Revenue Service guidelines if you still have questions.

- Click Done to save the updates.

- Continue to print the document, save it, or send it via Email, text message, Fax, or USPS without leaving your browser.

How to modify Get HI DoT GEW-TA-RV-5 2014: personalize forms online

Utilize the benefits of our comprehensive online document editor while handling your paperwork. Fill out the Get HI DoT GEW-TA-RV-5 2014, mark the most crucial details, and seamlessly make any other required modifications to its content.

Preparing documents digitally is not only time-efficient but also allows for the alteration of the template according to your requirements. If you plan to manage the Get HI DoT GEW-TA-RV-5 2014, think about using our powerful online editing tools. In case of a mistake or if you input the requested data in the incorrect field, you can promptly adjust the document without having to restart from the beginning as required in manual completion. Furthermore, you can emphasize the critical information in your document by coloring certain content, underlining them, or encircling them.

Follow these quick and easy steps to complete and alter your Get HI DoT GEW-TA-RV-5 2014 online:

Our broad online solutions are the easiest way to complete and modify Get HI DoT GEW-TA-RV-5 2014 according to your specifications. Use it to prepare personal or commercial paperwork from any location. Access it in a browser, make any necessary changes to your forms, and revisit them at any time in the future - they will all be securely stored in the cloud.

- Access the file in the editor.

- Enter the required details in the empty fields using Text, Check, and Cross tools.

- Navigate through the document to ensure no essential sections of the template are overlooked.

- Encircle some of the vital details and attach a URL to it if necessary.

- Employ the Highlight or Line tools to emphasize the most significant information.

- Choose colors and thickness for these lines to enhance the professional appearance of your sample.

- Remove or obscure the information you prefer to keep hidden from others.

- Replace any content with errors and insert the text you require.

- Conclude modifications with the Done button as soon as you verify that everything is accurate in the document.

Related links form

Subcontractors in Hawaii may deduct certain amounts related to the general excise tax based on their business activities. This deduction helps to alleviate the financial burden of paying taxes on income earned. Keeping clear financial records is crucial to ensure compliance and maximize available deductions. The HI DoT GEW-TA-RV-5 is an excellent resource for subcontractors navigating these tax rules.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.