Get Hi Dot G-49 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

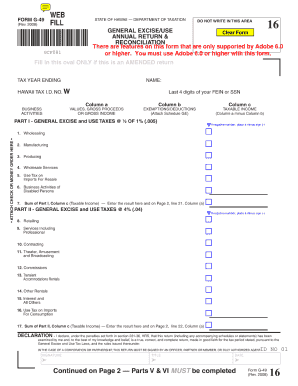

Tips on how to fill out, edit and sign HI DoT G-49 online

How to fill out and sign HI DoT G-49 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Reporting your income and filing all the essential tax documents, including HI DoT G-49, is the exclusive duty of a US citizen.

US Legal Forms simplifies your tax organization and accuracy significantly.

Keep your HI DoT G-49 safe. Ensure that all your pertinent paperwork and records are properly stored while being mindful of the deadlines and tax regulations set forth by the Internal Revenue Service. Make it easy with US Legal Forms!

- Obtain HI DoT G-49 from your web browser using your device.

- Access the editable PDF form with a click.

- Start completing the web template field by field, utilizing the instructions of the advanced PDF editor's interface.

- Carefully input text and numerical data.

- Click the Date field to auto-fill the current date or modify it manually.

- Utilize Signature Wizard to create your personalized e-signature and certify in moments.

- Refer to the IRS instructions if you have further inquiries.

- Select Done to save the modifications.

- Continue to print the document, save it, or send it via email, text message, fax, or USPS without exiting your browser.

How to modify Get HI DoT G-49 2008: personalize forms online

Utilize the features of the versatile online editor while completing your Get HI DoT G-49 2008. Employ the collection of tools to swiftly fill in the gaps and provide the necessary information in no time.

Completing documents is labor-intensive and costly unless you have pre-made fillable templates that you can complete digitally. The most straightforward way to tackle the Get HI DoT G-49 2008 is to leverage our specialized and multi-functional online editing tools. We equip you with all the essential tools for quick form completion and allow you to make any modifications to your forms, tailoring them to any specifications. Additionally, you can comment on the changes and leave notes for others involved.

Here’s what you can accomplish with your Get HI DoT G-49 2008 in our editor:

Managing your Get HI DoT G-49 2008 in our robust online editor is the fastest and most efficient means to handle, submit, and share your paperwork as you require from anywhere. The tool operates from the cloud so that you can access it from any location on any internet-enabled device. All forms you create or fill out are securely stored in the cloud, ensuring you can always retrieve them when needed and be confident that they won’t be lost. Stop squandering time on manual document completion and eliminate physical paperwork; conduct everything online with minimal effort.

- Complete the gaps using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize important information with a preferred color or underline them.

- Mask private details using the Blackout option or simply erase them.

- Upload images to illustrate your Get HI DoT G-49 2008.

- Substitute the original text with one that fits your requirements.

- Add comments or sticky notes to converse with others regarding the updates.

- Remove unnecessary fillable fields and assign them to specific recipients.

- Secure the template with watermarks, include dates, and bates numbers.

- Distribute the document in various methods and save it on your device or the cloud in multiple formats after finishing editing.

Get form

A Schedule G tax form is used in particular instances to report supplemental information related to the general excise tax in Hawaii. This form may be attached to your G49 and helps clarify specific details about your gross income. Understanding how to complete this form correctly enables you to communicate necessary information to the state effectively. For a successful filing experience, consider using resources that explain the HI DoT G-49 and its associated forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.