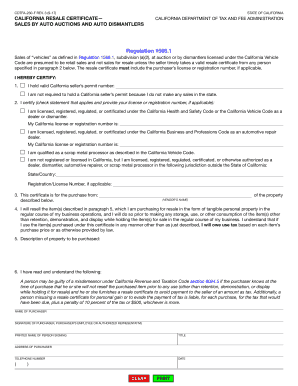

Get Ca Cdtfa-230-f 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA CDTFA-230-F online

How to fill out and sign CA CDTFA-230-F online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax period commenced unexpectedly or you merely overlooked it, it may likely cause issues for you. CA CDTFA-230-F is not the simplest one, but you have no reason to be concerned in any situation.

By utilizing our advanced online software, you will learn the correct method to complete CA CDTFA-230-F even in times of significant time constraints. All you have to do is adhere to these basic guidelines:

With this robust digital solution and its beneficial tools, submitting CA CDTFA-230-F becomes easier. Don’t hesitate to utilize it and spend more time on leisure activities rather than preparing documents.

Access the document with our expert PDF editor.

Enter the necessary information in CA CDTFA-230-F, using the fillable fields.

Insert images, crosses, tick marks, and text boxes, if required.

Repeated information will be automatically populated after the initial entry.

If you encounter any difficulties, utilize the Wizard Tool. You will receive helpful hints for easier completion.

Remember to add the date of application.

Create your distinct e-signature once and place it in all the required areas.

Review the information you have provided. Correct any errors if necessary.

Hit Done to complete your modifications and choose how you will send it. You have the option to use digital fax, USPS or email.

You can download the document to print later or upload it to cloud storage such as Dropbox, OneDrive, etc.

How to modify Get CA CDTFA-230-F 2017: personalize forms online

Experience an effortless and environmentally friendly method for altering Get CA CDTFA-230-F 2017. Utilize our dependable online service and save a considerable amount of time.

Creating each document, including Get CA CDTFA-230-F 2017, from the ground up demands excessive effort, so having a reliable solution of pre-prepared form templates can significantly enhance your productivity.

However, editing them can be tricky, especially with files in PDF format. Fortunately, our broad catalog contains an integrated editor that allows you to seamlessly fill out and modify Get CA CDTFA-230-F 2017 without leaving our site, so you can avoid wasting time processing your forms. Here’s what you can accomplish with your document using our solution:

Whether you need to complete adjustable Get CA CDTFA-230-F 2017 or any other template available in our collection, you are on the right path with our online document editor. It’s simple and secure and doesn't require any specialized skills. Our web-based tool is crafted to handle practically everything you can consider regarding document editing and processing.

Leave behind the archaic method of managing your forms. Choose a more effective solution to help streamline your tasks and reduce paper dependency.

- Step 1. Find the required form on our website.

- Step 2. Press Get Form to open it in the editor.

- Step 3. Take advantage of professional editing tools that enable you to add, remove, annotate, and highlight or blackout text.

- Step 4. Create and add a legally-recognized signature to your document by using the sign option from the top toolbar.

- Step 5. If the template layout isn’t aligned with your preferences, use the features on the right to delete, add more, and organize pages.

- Step 6. Incorporate fillable fields so that other individuals can be invited to fill out the template (if applicable).

- Step 7. Distribute or share the document, print it, or select the format in which you’d like to receive the document.

To determine if you owe use tax in California, assess your recent purchases that do not include sales tax, such as online or out-of-state transactions. The CA CDTFA-230-F form can help you report these purchases accurately. Reviewing your buying history and comparing it with tax regulations will enable you to identify any potential liabilities. If in doubt, consulting a tax professional can provide clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.