Loading

Get Hi Bfs-rp-p-51 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI BFS-RP-P-51 online

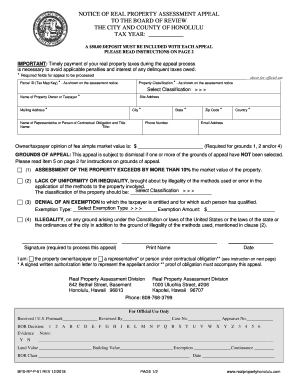

Filing an appeal for your real property assessment can be a straightforward process when you have clear guidance. This guide will walk you through the steps needed to complete the HI BFS-RP-P-51 form online, ensuring that you have all the necessary information to submit your appeal effectively.

Follow the steps to successfully complete the HI BFS-RP-P-51 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the tax year in the designated field, ensuring you include the correct year you are appealing.

- Make sure to include a $50.00 deposit with your appeal, as this is a required step for the processing of your appeal.

- Enter the parcel ID (Tax Map Key) exactly as it appears on your assessment notice in the corresponding field.

- Provide the property classification using the classification noted on your assessment notice.

- Input your name as the property owner or taxpayer in the required field.

- Fill in the site address and mailing address fields fully, including city, state, and zip code.

- Complete the phone number, country, and email address fields to ensure you can be reached regarding your appeal.

- State your opinion of the fee simple market value of the property, which is required for certain grounds of appeal.

- Select the grounds of your appeal by checking the appropriate boxes. Ensure you select at least one ground to avoid dismissal of your appeal.

- If applicable, provide your signature, print your name, and confirm whether you are the property owner, a representative, or under contractual obligation.

- Review all entries for accuracy and completeness before you proceed.

- Once fully completed, you can save the changes, download, print, or share the form as needed.

Complete your HI BFS-RP-P-51 online today to ensure your appeal is processed promptly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 homestead exemption for school taxes, in addition to the $25,000 exemption for all homeowners.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.