Loading

Get Gu Grt-1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GU GRT-1 online

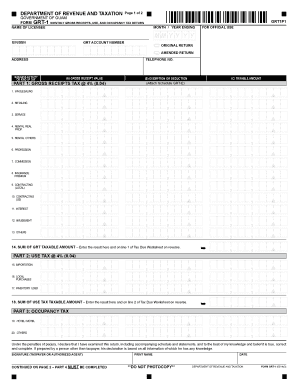

Completing the GU GRT-1 form is essential for accurately reporting your monthly gross receipts, use, and occupancy taxes. This guide will provide you with clear instructions to help you fill out the form confidently and correctly.

Follow the steps to successfully complete the GU GRT-1 form online.

- Press the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Begin by entering the name of the licensee in the designated field. This is the individual or business responsible for submitting the tax return.

- Select the month and year ending for the reporting period. Input the correct MM YYYY format.

- Provide the Employer Identification Number (EIN) or Social Security Number (SSN) corresponding to the business.

- Enter your GRT account number in the designated field to uniquely identify your tax record.

- Fill in the business address where the licensed operations occur.

- Indicate the primary business activity or type of tax you are reporting by selecting the appropriate option from the listed categories.

- Complete the Gross Receipts Tax section by entering the gross receipt value, any exemptions or deductions, and calculating the taxable amount.

- Proceed to fill out the Use Tax section for any applicable importation, local purchases, or inventory used.

- Complete the Occupancy Tax section by entering data related to hotel/motel or other occupancy activities.

- Review all sections for accuracy before signing. Ensure you declare the truthfulness of the information under penalties of perjury.

- Sign the form, print your name, and date it. If someone else prepared the return, provide their information as well.

- Once completed, save the changes, and you can choose to download, print, or share the form as needed.

Complete your GU GRT-1 form online today for accurate tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Several states in the U.S. implement Gross Receipts Taxes, including New Mexico, Washington, and Nevada. Each state has its own rules and rates regarding GRT, which can vary significantly. Learning about these variations, especially if you're familiar with the GU GRT-1, can help you navigate the tax landscape effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.