Get Ga Rd-1061 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA RD-1061 online

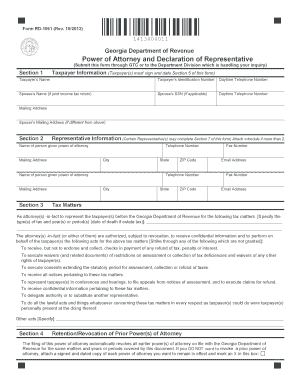

Filling out the GA RD-1061, also known as the Power of Attorney and Declaration of Representative form, is an essential process for taxpayers wishing to delegate their authority to another person for tax matters. This guide provides a clear and supportive approach to completing the form online, ensuring that users can navigate each section with confidence.

Follow the steps to complete the GA RD-1061 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, input taxpayer information. This includes the taxpayer's name, identification number, daytime telephone number, and if applicable, the spouse's name and social security number. Provide mailing addresses for both the taxpayer and spouse as necessary.

- Move to Section 2 to enter representative information. Include the names, addresses, and telephone numbers for each person granted power of attorney. If there are more than two representatives, attach a schedule with the additional names.

- In Section 3, specify the tax matters for which the representatives are authorized. Clearly define the types of tax and applicable years or periods. You can also indicate acts that are authorized by striking through any that do not apply.

- Section 4 confirms the retention or revocation of prior powers of attorney. If you do not wish to revoke a prior power of attorney, ensure that the necessary documents are attached and check the appropriate box.

- Complete Section 5 by having the taxpayer(s) sign and date the form. It is important to note that the power of attorney is not valid until this section is filled out. If signing on behalf of a taxpayer, ensure proper authorization.

- In Section 6, address the witnessing or acknowledgment that the form has been executed. This can be done by two disinterested witnesses or a notary public, depending on the qualifications of the representative.

- Section 7 includes the declaration of representative. The representative must sign, affirming their authority to represent the taxpayer and provide relevant licensing details.

- After completing all sections, review for accuracy. Once verified, you can save changes, download, print, or share the completed form online based on your needs.

Start completing your GA RD-1061 online today for a smoother tax management experience.

Get form

Related links form

Setting up a Georgia withholding account involves registering with the Georgia Department of Revenue. You can do this online or by submitting the relevant forms to initiate your account. Having a withholding account is essential for employers to withhold state income tax from employee wages. Using resources like USLegalForms can help streamline this process and ensure compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.