Loading

Get Ga It-qbr 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA IT-QBR online

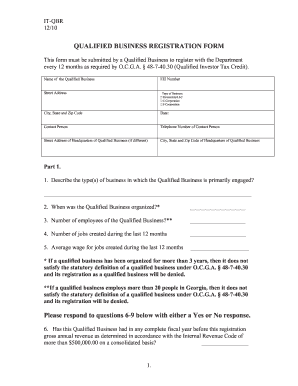

The GA IT-QBR is a vital form that Qualified Businesses must submit annually to register with the Department for the Qualified Investor Tax Credit. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully fill out the GA IT-QBR online.

- Use the ‘Get Form’ button to obtain the GA IT-QBR form and open it in your preferred editing tool.

- Begin by entering the name of the Qualified Business in the specified field.

- Next, include the FEI Number, which is essential for identification purposes.

- Fill in the street address and specify the city, state, and zip code of the business location.

- Select the type of business structure from the options available: Partnership/LLC, C Corporation, or S Corporation.

- Provide the date of completion in the designated field.

- Indicate the contact person's name, along with their telephone number for further communication.

- If the headquarters address differs from the primary business address, fill in that information, including city, state, and zip code.

- In Part 1, answer the questions regarding the nature of the business, the date of organization, number of employees, and job creation data.

- Respond with either Yes or No to questions 6 through 9, providing accurate information based on the criteria specified.

- Ensure that you sign the certification section, including the title of the person signing and the date.

- Finally, review the entire form for accuracy and completeness before saving changes, downloading, printing, or sharing the completed form.

Complete your GA IT-QBR form online today to ensure your business remains compliant.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

There are multiple reasons your e-file may not go through, such as incorrect information, software errors, or issues with the e-filing system. Double-check your entries and ensure compatibility with IRS guidelines. If you continue to experience difficulties, consider using US Legal Forms for personalized assistance and ensure your taxes are filed accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.