Get Ga G-4p 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA G-4P online

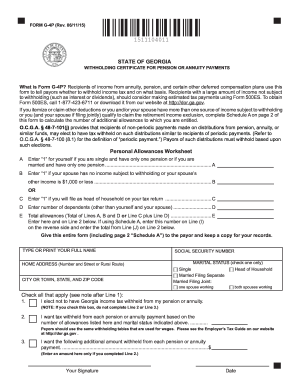

Form GA G-4P is used by recipients of pension or annuity payments to specify their income tax withholding preferences. Completing this form online can simplify the process of managing your tax withholdings and ensuring compliance with Georgia state tax regulations.

Follow the steps to complete your GA G-4P form accurately.

- Press the ‘Get Form’ button to obtain the GA G-4P and open it in the online editor.

- Begin by typing or printing your full name, home address, city or town, state, and ZIP code in the designated fields.

- Enter your Social Security number in the provided field. This is important for identification purposes.

- Select your marital status by checking the appropriate box. Options include Single, Head of Household, or Married (with further distinctions for those filing jointly).

- Decide whether to withhold Georgia income tax from your pension or annuity by marking the applicable checkboxes under the options provided. If you opt not to have tax withheld, leave Lines 2 and 3 blank.

- If you choose to have tax withheld, indicate the number of allowances based on what you calculated or determined from your situation.

- If necessary, complete Schedule A on page 2 to determine any additional allowances. Make sure to perform the calculations accurately for lines 1 through 3.

- Once you have completed all necessary sections, review the information for accuracy before saving your changes.

- Finally, download, print, or share your completed GA G-4P form as needed. Retain a copy for your records.

Complete your GA G-4P form online today to manage your tax withholdings effectively.

Get form

Related links form

The GA G-4P is a withholding form specific to Georgia that pertains to pensions and retirement income. By completing this form, retirees can establish the appropriate amount of state tax withheld from their pension payments. Understanding the GA G-4P helps you comply with Georgia tax regulations while optimizing your retirement finances. It’s an essential form for managing your tax liabilities effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.