Loading

Get Ga Dor St-3use 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR ST-3USE online

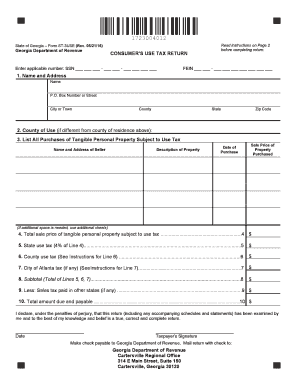

The GA DoR ST-3USE form is essential for individuals or firms who are liable for consumer use tax in Georgia but are not registered dealers. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the GA DoR ST-3USE online effortlessly.

- Click the ‘Get Form’ button to obtain the GA DoR ST-3USE form and open it in your document editor.

- Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the designated space at the top of the form.

- In Line 1, provide your name and address, including your county of residence.

- For Line 2, specify the county where the purchased property was used if it differs from your county of residence.

- In Line 3, list all purchases of tangible personal property that are subject to use tax. Include the name and address of the seller, a description of the property, the date of purchase, and the sale price.

- Add the total sale price of tangible personal property from Line 3 and enter it on Line 4.

- Calculate the state use tax by multiplying the total from Line 4 by 4% and enter this amount on Line 5.

- Determine the county use tax rate applicable to your county of residence or use by visiting the Georgia Department of Revenue and enter this value multiplied by the amount from Line 4 on Line 6.

- If either your residence or the use of the purchased items is within the City of Atlanta, multiply the total from Line 4 by 1% and input this on Line 7.

- Sum the amounts on Lines 5, 6, and 7 and enter the total on Line 8.

- If applicable, enter any sales tax paid in other states on Line 9.

- On Line 10, subtract the amount on Line 9 from Line 8 to determine the total amount due.

- Finally, sign and date the form, ensuring it is now ready to be submitted. Save any changes, and download, print, or share as necessary.

Complete your GA DoR ST-3USE form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, Georgia's state-level sales tax is 4%, but local jurisdictions can impose additional sales taxes, bringing the total to approximately 7% in many areas. The overall rate may vary based on local taxation. To ensure you are up to date with the latest tax rates, visit the US Legal Forms site for current information and helpful tools.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.