Loading

Get Ga Dor It-rd 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR IT-RD online

Filling out the GA DoR IT-RD form online is a straightforward process designed to help businesses claim the research tax credit for qualified expenses. This guide provides step-by-step instructions to ensure you accurately complete the form and make the most of the available tax benefits.

Follow the steps to complete the GA DoR IT-RD form online.

- Press the ‘Get Form’ button to access the GA DoR IT-RD form and open it in your preferred editor.

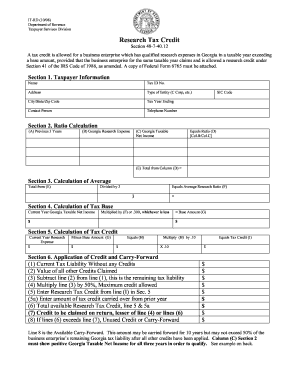

- In Section 1, fill in the taxpayer information. This includes your name, tax identification number, address, type of entity, city, state, zip code, tax year ending, contact person, telephone number, and Standard Industrial Classification (SIC) code.

- Move to Section 2 to perform the ratio calculation. You will need to enter the previous three years of data: Georgia research expenses and Georgia taxable net income for each year. Calculate the ratio by dividing the Georgia research expenses by the Georgia taxable net income for each respective year.

- In Section 3, calculate the average research ratio by totaling the results from Section 2 and dividing by three. This will give you the average research ratio.

- Proceed to Section 4 to calculate the tax base. Multiply the current year's Georgia taxable net income by the average research ratio you computed or by 0.300, whichever amount is lower to establish the base amount.

- In Section 5, calculate the tax credit. Subtract the base amount from the current year's research expense to find the result. Then, multiply that result by 0.10 to determine the tax credit.

- Section 6 involves the application of your credit and the carry-forward calculation. Enter the current tax liability without any credits, the value of all other credits, and then compute the remaining tax liability. Calculate the maximum credit allowed, and combine it with any prior year credit carry-over.

- Finally, review all sections to confirm accuracy. Once you have filled out the form completely, save your changes, download the document, or print it for your records.

Complete your GA DoR IT-RD form online today to take advantage of potential tax credits for your business.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The $250 check you received from the Georgia Department of Revenue may be part of a tax refund or relief program designed to help residents financially. This could be related to recent legislation aimed at providing financial assistance. For details on the specifics, check the GA DoR IT-RD documentation for clarity on your eligibility.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.