Loading

Get Ga Dor It-rd 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR IT-RD online

Filling out the GA DoR IT-RD form is an important step for business enterprises seeking a research tax credit in Georgia. This guide provides a clear and supportive approach to completing the form online, ensuring that users understand each section and its requirements.

Follow the steps to successfully complete the GA DoR IT-RD form online.

- Use the ‘Get Form’ button to obtain the GA DoR IT-RD form and open it in your preferred digital format.

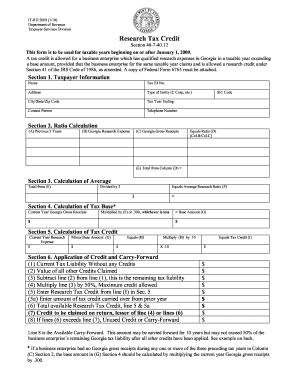

- In Section 1, provide taxpayer information. Fill in your name, tax ID number, address, entity type (e.g., C Corporation), city, state, zip code, tax year ending date, contact person, and telephone number. Ensure all the details are accurate and current.

- Proceed to Section 2, Ratio Calculation. Enter the previous three years' Georgia research expenses and gross receipts for your business in the respective columns. Calculate the ratio by dividing the Georgia research expense by the Georgia gross receipts and sum the ratios to find the total.

- In Section 3, Calculation of Average, take the total from Section 2 and divide by three to compute the average research ratio.

- Navigate to Section 4 for Calculation of Tax Base. Input your current year Georgia gross receipts and multiply by the average research ratio or 0.300, whichever is less, to determine the base amount.

- In Section 5, Calculation of Tax Credit, record your current year research expenses and compute the base amount. Subtract the base amount from your current year research expenses to find the value, then multiply this by 0.10 to determine the tax credit.

- Move on to Section 6 for Application of Credit and Carry-Forward. Complete the calculations for your current tax liability, claimed credits, and remaining tax liability, following the provided instructions closely. Calculate the total available research tax credit and record the claimed credit for your return.

- After entering all required data, review the entire form for accuracy. Save any changes, and download or print the form as needed before submitting.

Complete your GA DoR IT-RD form online today to take advantage of your research tax credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When filing your Georgia tax return, you should attach all necessary forms, including W-2s, 1099s, and any relevant schedules. It’s important to ensure that you include documentation supporting your income and deductions. For a comprehensive checklist and assistance, consider using uslegalforms, which can guide you through the attachments required for your GA DoR IT-RD submissions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.