Loading

Get Ga Dor It-consol 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR IT-CONSOL online

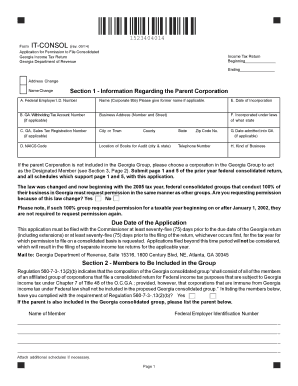

The GA DoR IT-CONSOL form is an essential document for corporations wishing to file a consolidated Georgia income tax return. This guide provides a step-by-step approach to assist users in accurately completing this online application.

Follow the steps to successfully fill out the GA DoR IT-CONSOL form.

- Press the ‘Get Form’ button to access the GA DoR IT-CONSOL form and open it for editing.

- In Section 1, provide the information regarding the parent corporation. This includes the Federal Employer Identification Number (FEIN), Georgia Withholding Tax Account Number (if applicable), and the business address. Ensure to also indicate the date of incorporation and the state under which the corporation is incorporated.

- Complete the sections for members to be included in the group. List all members of the affiliated group along with their Federal Employer Identification Numbers. Be sure that these corporations are compliant with Georgia tax regulations.

- Designate a member authorized to receive notices by filling out the relevant information in Section 3. If the parent corporation is part of the group, a different member may be designated.

- Answer the general questions presented in Section 4. Provide details regarding any additional forms required, such as the inclusion of pro forma pages or loss schedules as necessary.

- If applicable, address any questions regarding interest expenses or other expenses related to entities not included in the Georgia group, making sure to provide adequate details as specified in the form.

- Finally, ensure all sections of the form are duly completed and reviewed. Users can then save changes, download, print, or share the completed form as necessary.

Complete your forms online today to ensure timely processing of your application.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Receiving a $500 deposit from Georgia generally indicates that you qualify for a one-time tax refund. This refund may be part of the state’s efforts to return surplus funds to taxpayers. If you want clarity on this deposit, GA DoR IT-CONSOL can provide you with the necessary information to understand your eligibility.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.