Get Ga Dor G-7 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR G-7 online

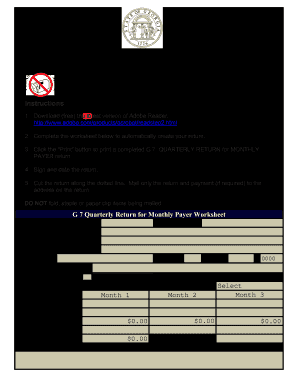

The GA DoR G-7 form is essential for reporting withholding tax for monthly payers in Georgia. This guide provides comprehensive instructions on how to complete the form accurately online, ensuring you meet all requirements and deadlines.

Follow the steps to complete your GA DoR G-7 form online.

- Click ‘Get Form’ button to access the GA DoR G-7 online form and open it in your preferred document editor.

- Begin by entering your GA Withholding ID in the specified field. This identifier is essential for processing your submission correctly.

- Provide your name and address. Ensure that all information is accurate and up-to-date to avoid processing delays.

- Enter your FEI Number accurately. This number is necessary for federal tax identification.

- Select your state and fill in your zip code. This information helps in validating your payment.

- Input your telephone number for any necessary follow-up from the department.

- Indicate if this is an amended return by selecting the appropriate box, if applicable.

- Complete the 'Tax Period' section, specifying the months in the quarter and filling in tax withheld for each month.

- Report any adjustments to tax in the provided fields, indicating whether the adjustments increase or decrease the tax amount.

- Calculate and input the total tax due after adjustments in the 'Tax Due' section.

- Fill in the 'Quarterly Total' by adding all monthly taxes withheld to report a consolidated amount.

- If you are enclosing a payment, specify the amount in the 'Amount Enclosed' field.

- Finally, review all entries for accuracy and completeness, and then save your changes. You can download, print, or share the completed form as needed.

Complete your GA DoR G-7 form online today to ensure timely submission and compliance with tax regulations.

Get form

Registering a general partnership in Georgia involves filing a registration statement with the Secretary of State's office. This process requires you to provide key details about the partnership, such as the names of the partners and the business address. Once registered, your partnership will need to comply with state tax regulations, including obtaining a GA withholding ID if applicable. The US Legal Forms platform can assist you with the registration process and provide necessary templates to simplify your experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.