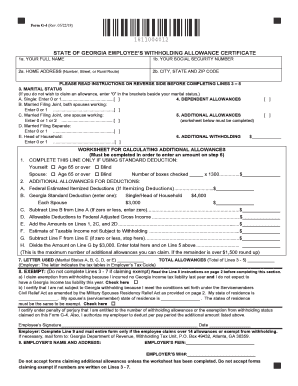

Get Ga Dor G-4 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign GA DoR G-4 online

How to fill out and sign GA DoR G-4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your income and submitting all the essential tax documents, including GA DoR G-4, is the exclusive responsibility of a US citizen.

US Legal Forms facilitates the accessibility and precision of your tax management.

Store your GA DoR G-4 securely. Ensure that all your accurate documents and records are organized while keeping in mind the deadlines and tax regulations established by the IRS. Simplify it with US Legal Forms!

- Retrieve GA DoR G-4 on your web browser from any device.

- Access the interactive PDF form with a single click.

- Begin filling out the form field by field, utilizing the prompts of the advanced PDF editor's interface.

- Accurately enter text and figures.

- Click the Date field to automatically insert the current date or modify it manually.

- Use Signature Wizard to create your personalized e-signature and authorize in moments.

- Refer to Internal Revenue Service guidelines if you have any further questions.

- Hit Done to save your changes.

- Continue to print the document, download, or share it via email, text messages, fax, or USPS without leaving your browser.

How to modify Get GA DoR G-4 2018: personalize forms online

Put the appropriate document management tools at your disposal. Complete Get GA DoR G-4 2018 with our trustworthy solution that includes editing and eSignature features.

If you wish to finalize and validate Get GA DoR G-4 2018 online without difficulties, then our online cloud-based option is the perfect solution. We offer an extensive template-based library of ready-to-use documents you can adjust and complete online. Additionally, you don’t have to print the document or utilize third-party services to make it fillable. All essential tools will be accessible for your use as soon as you access the file in the editor.

Let’s review our online editing tools and their main features. The editor possesses a user-friendly interface, so it won’t take much time to learn how to use it. We’ll examine three primary components that allow you to:

In addition to the features mentioned above, you can protect your file with a password, apply a watermark, convert the file to the desired format, and much more.

Our editor simplifies the process of modifying and validating the Get GA DoR G-4 2018. It enables you to accomplish practically everything when it comes to dealing with forms. Furthermore, we always ensure that your document modification experience is secure and adheres to the major regulatory standards. All these aspects make utilizing our solution even more enjoyable.

Obtain Get GA DoR G-4 2018, implement the required edits and adjustments, and receive it in the preferred file format. Try it out today!

- Modify and comment on the template

- The upper toolbar features tools that assist you in emphasizing and censoring text, excluding images and graphic elements (lines, arrows, and checkmarks, etc.), adding your signature, initializing, dating the document, and more.

- Organize your documents

- Utilize the toolbar on the left if you wish to rearrange the form or/and eliminate pages.

- Prepare them for distribution

- If you want to make the template fillable for others and distribute it, you can employ the tools on the right and insert various fillable fields, signature and date, text box, etc.

Get form

Related links form

You are required to file Form 700 if you receive any type of income from Georgia sources and meet the state's specified income thresholds. This includes income from employment, rental properties, or businesses operating within Georgia. The USLegalForms platform can assist you in ensuring you have all the accurate information and forms necessary to fulfill this requirement.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.