Loading

Get Ga Dor Crf-002 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR CRF-002 online

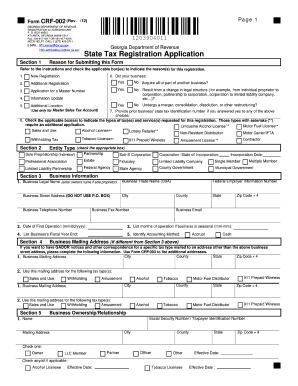

Filling out the GA DoR CRF-002 is an important step for individuals and businesses registering for state taxes in Georgia. This guide is designed to assist users in navigating each section of the form with clarity and precision for a successful submission.

Follow the steps to complete the GA DoR CRF-002 online.

- Press the ‘Get Form’ button to access the GA DoR CRF-002 and open it for completion.

- In Section 1, indicate your reason for registration by checking the applicable boxes. This could include starting a new business, adding an additional tax registration, or updating information.

- Proceed to Section 2 to select your business' ownership structure. If your business is a corporation, be sure to include the state and date of incorporation.

- In Section 3, fill in your business information, including the legal business name, trade name, Federal Employer Identification number, business address, phone number, fax number, and email address. Also, provide the date of first operation and any seasonal operation months.

- For Section 4, complete the business mailing address if different from the business street address, ensuring all correspondence is directed appropriately.

- In Section 5, provide the necessary information regarding all individuals involved in the business to establish the ownership relationship.

- Section 6 asks for details about your business activities. Indicate your business type, answer questions regarding motor fuel sales, and provide a description of products or services offered along with the NAICS code.

- Complete Section 7 by indicating whether you will have employees and identifying the party responsible for payroll taxes, including the date of your first payroll.

- Finally, sign in Section 8 as an authorized person—this can be an owner, partner, or corporate officer. Ensure your application is complete and accurate before saving changes, downloading, or printing the form.

Begin the online filing process today and ensure your compliance with Georgia state tax regulations.

Related links form

To qualify for tax exemption in Georgia, you must complete the required application forms and meet the criteria set by the GA DoR. Generally, being a non-profit or making qualifying purchases will help in obtaining exemption. Always keep updated with the latest requirements to ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.