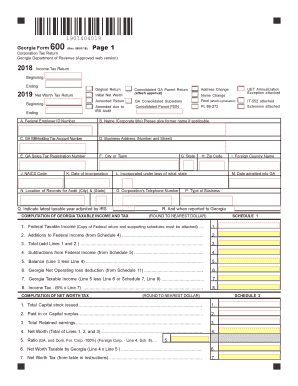

Get Ga Dor 600 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign GA DoR 600 online

How to fill out and sign GA DoR 600 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Documenting your income and submitting all essential tax documents, including GA DoR 600, is the exclusive responsibility of a US citizen. US Legal Forms simplifies your tax administration, making it more convenient and effective.

You can access any legal templates you require and fill them out online.

Safeguard your GA DoR 600. Ensure that all your pertinent documents and information are organized, keeping in mind the deadlines and tax regulations established by the IRS. Make it easy with US Legal Forms!

- Obtain GA DoR 600 in your browser from any device.

- Access the fillable PDF file with just a click.

- Start completing the online template field by field, following the prompts of the state-of-the-art PDF editor's interface.

- Carefully input text and numbers.

- Choose the Date box to automatically enter the current date or modify it manually.

- Utilize Signature Wizard to create your unique e-signature and approve in moments.

- Refer to the Internal Revenue Service guidelines if you still have inquiries.

- Press Done to store the changes.

- Proceed to print the document, save, or share it via email, text messaging, fax, or USPS without leaving your browser.

How to revise Get GA DoR 600 2018: personalize forms online

Eliminate the chaos from your documentation routine. Uncover the most efficient method to locate, alter, and submit a Get GA DoR 600 2018.

The task of compiling Get GA DoR 600 2018 necessitates accuracy and concentration, especially for individuals who are not well-versed in such responsibilities. It is crucial to acquire an appropriate template and populate it with the correct details. With the right tools for managing documents, you can have everything you need at your fingertips.

It is straightforward to streamline your revision process without acquiring new abilities. Identify the suitable version of Get GA DoR 600 2018 and complete it promptly without toggling between your browser windows. Explore additional resources to tailor your Get GA DoR 600 2018 form in the editing mode.

While you are on the Get GA DoR 600 2018 page, simply click the Get form button to initiate editing. Insert your information directly into the form, as all necessary tools are available right here. The template is pre-structured, so the user’s input required is minimal. Just utilize the interactive fillable fields in the editor to efficiently finalize your paperwork. Click on the form and enter the editor mode right away. Fill out the interactive field, and your document is ready.

Occasionally, a tiny mistake can jeopardize the entire form when completed manually. Disregard inaccuracies in your documentation. Locate the samples you need swiftly and finalize them electronically using an intelligent editing tool.

- Surround the document with additional text if necessary. Employ the Text and Text Box tools to place text in a distinct box.

- Incorporate pre-designed visual elements like Circle, Cross, and Check with respective tools.

- If required, capture or insert images into the document using the Image tool.

- If you need to sketch something on the document, utilize the Line, Arrow, and Draw tools.

- Experiment with the Highlight, Erase, and Blackout tools to modify the text in the document.

- To add remarks to certain sections of the document, click on the Sticky tool and position a note wherever desired.

Get form

Related links form

When answering the question 'Are you exempt from withholding?', you should evaluate whether your financial situation justifies exemption status. If you expect to owe no taxes due to low income or available tax credits, you might answer yes. However, if you anticipate owing taxes, answering no is more appropriate. Refer to the guidelines in the GA DoR 600 to help determine your correct response.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.