Loading

Get Ga Cd-14c 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA CD-14C online

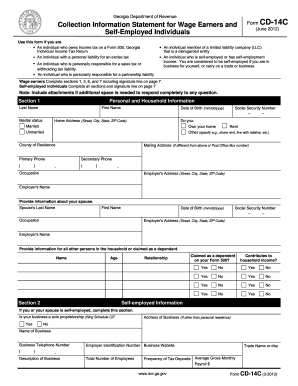

Filling out the GA CD-14C is an essential process for individuals who owe income tax or have tax liabilities in Georgia. This guide provides clear, step-by-step instructions to assist users of all backgrounds in completing the form accurately and efficiently.

Follow the steps to complete the GA CD-14C online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out Section 1, which includes your personal and household information. Provide your last name, first name, marital status, home address, county of residence, mailing address, and primary and secondary phone numbers. Don't forget to enter your Social Security number and date of birth.

- Continue completing Section 1 by detailing your occupation and employer's information. If you are married, provide your spouse's name, date of birth, occupation, Social Security number, and employer details.

- In Section 2, you must provide information about your self-employment status. Indicate if your business qualifies as a sole proprietorship, and supply the name of your business, its address, and its telephone number.

- Proceed with Section 3, where you will detail your personal assets. This involves listing bank account information — including checking, savings, and online accounts — as well as investments, retirement accounts, and other valuable items. Make sure to use the appropriate calculations to assess net values accurately.

- In Section 4, provide details about business assets if you are self-employed. Include bank accounts and any business-related ownerships or tools.

- Fill out Section 5, where you will detail your business income and expenses. Add together your gross receipts and any other income sources to calculate your total monthly gross business income.

- Section 6 requires you to outline your household income and expenses. Gather all contributions to your household income from all sources, and detail your average monthly expenses.

- Move to Section 7, where you will calculate your minimum offer amount based on your total available assets and remaining income.

- Finally, review your entire form for accuracy, sign the document, include any required attachments, and save your changes. You can download, print, or share the form as necessary.

Complete your GA CD-14C form online today for a smoother tax process.

Related links form

In Georgia, it typically takes about 15 to 20 business days to receive your articles of incorporation. However, using expedited services can significantly speed up the process. This can be particularly useful if you need your GA CD-14C documentation quickly. To ensure a smooth process, you can use US Legal Forms to get started with your filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.