- US Legal Forms

- Form Library

- Tax Forms

- Alaska Tax Forms

- AK 6000i 2020

Get AK 6000i 2020-2024

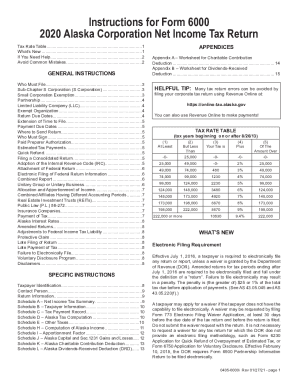

Instructions for Form 6000 2016 Alaska Corporation Net Income Tax Return Tax Rate Table...............................................................................1 What s New...................................................................................1 If You Need Help*..........................................................................2 Avoid Common Mistakes...............................................................2 GENERAL INSTRUCTIONS Who Must File...............................................................................3 Sub-Chapter S Corporation S Corporation .................................3 Small Corporation Exemption*.......................................................3 Partnership*...................................................................................4 Limited Liability Company LLC ...................................................4 Exempt Organization*....................................................................4 Return Due Dates..........................................................................4 Extension of Time to File...............................................................5 Payment Due Dates......................................................................5 Where to Send Return*..................................................................5 Who Must Sign*.............................................................................5 Paid Preparer Authorization*.........................................................5 Estimated Tax Payments...............................................................5 Quick Refund.................................................................................5 Filing a Consolidated Return*........................................................5 Adoption of the Internal Revenue Code IRC ............................... 6 Attachment of Federal Return*......................................................6 Electronic Filing of Federal Return Information*............................ 6 Combined Report..........................................................................6 Unitary Group or Unitary Business................................................7 Allocation and Apportionment of Income.......................................7 Combined Affiliates Having Different Accounting Periods............. 7 Real Estate Investment Trusts REITs .........................................7 Public Law P.L* 86-272................................................................7 Insurance Companies...................................................................7 Payment of Tax..............................................................................7 Alaska Interest Rates....................................................................8 Amended Returns.........................................................................8 Adjustments to Federal Income Tax Liability.................................8 Protective Claim*...........................................................................8 Late Filing of Return*.....................................................................8 Late Payment of Tax......................................................................8 Failure to Electronically File..........................................................8 Voluntary Disclosure Program*......................................................8 Disclaimers....................................................................................9 SPECIFIC INSTRUCTIONS Taxpayer Identification*..................................................................9 Contact Person*.............................................................................9 Return Information*........................................................................9 Schedule A Net Income Tax Summary.....................................10 Schedule B Taxpayer Information*............................................10 Schedule D Alaska Tax Computation*......................................10 Schedule E Other Taxes...........................................................11 Schedule H Computation of Alaska Income............................. 11 Schedule I Apportionment Factor.............................................12 APPENDICES Appendix A Worksheet for Charitable Contribution Deduction*................................................................................... 15 HELPFUL TIP Many tax return errors can be avoided by filing your corporate tax return using Revenue Online at https //online-tax.alaska*gov You can also use Revenue Online to make payments TAX RATE TABLE At Least tax years beginning on or after 8/26/13 Your Tax is -0- But Less Than 25 000 Of The Amount Over 49 000 74 000 99 000 124 000 173 000 198 000 222 000 10830 220 000 or more Plus WHAT S NEW Due Date Alert Updated for IRS 2/1/17 announcement Under AS 43.20.030 a a taxpayer must file its Alaska corporate income tax return 30 days after its federal return is due. Because of recent federal law changes Alaska tax return due dates have changed for tax years beginning after December 31 2015. To complicate matters further federal law now differentiates the due dates for C Corporation and S Corporations and provides an exception for certain fiscal year filers. Similarly final payment due dates are affected as noted below. The due dates for estimated tax payments have not changed* This federal legislation also changed the period that is covered by an extension of time to file for some returns as noted below. There are no changes to due dates for returns filed by exempt organizations or cooperatives. Due dates for partnership returns have also changed* Please see 0405-6000i Rev 03/06/17 - page 1 C Corporations Historically a federal corporate income tax return has been required to be filed by the 15th of the third month after the end of the tax year. March 15 for calendar-year taxpayers . With the new law the federal corporate income tax return is required to be filed by the 15th day of the fourth month after the end of the tax year. Since an Alaska corporate income tax return must be filed 30 days after the federal return the 2016 Alaska corporate income tax return for a calendar-year taxpayer will generally be due May 15 2017. A federal extension allows a six-month extension of time to file with some exceptions. This means that the extended due date for an Alaska corporate income tax return is the 15th day of the eleventh month after the end of the tax year. For a calendar-year taxpayer the extended due date for its Alaska corporate income tax return is November 15. The payment due date has been changed to the 15th day of the fourth month after the end of the tax year. Thus the payment due date for a calendar-year taxpayer is April 15 2017 for tax due on a 2016 return* Important exception A special rule applies to a C Corporation filing a return for a fiscal year ending June 30 20x1 and any shortyear return for a period ending in June . Federally a return for a tax period ending in June is due September 15 20x1. Therefore that corporation is required to file its Alaska corporate income tax return on October 15 20x1. The extension period for a fiscal year ending June 30 and any short-year return for a period ending in June is now seven months rather than six months . Therefore for a fiscal year ending June 30 20x1 the extended due date for an Alaska corporate income tax return is May 15 20x2. September 15 20x1. including fiscal years ending June 30 remains the 15th day of the Corporation a 2016 Alaska corporate income tax return must be filed by April 15 2017. extended due date for the Alaska corporate income tax return is the 15th day of the tenth month after the end of the tax year. For a calendar-year S Corporation the extended due date is October If any Alaska tax is due it must be paid by the 15th day of the third month after the end of the tax year. For a calendar-year S Corporation any tax due must be paid by March 15. The legislature passed HB 375 which greatly expanded the requirement for electronic filing of all tax returns. Effective July 1 2016 a taxpayer is required to electronically file any return or report unless a waiver is granted by the Department of Revenue DOR . This legislation also provided for a new penalty for failure to file electronically. The penalty is the greater of 25 or 1 of the total tax due before application of payments. See AS 43.05.045 and AS 43.05.220 f . A taxpayer may apply for a waiver if the taxpayer does not have the capability to file electronically. A waiver may be requested by filing Form 773 Electronic Filing Waiver Application at least 30 days before the due date of the tax return* It is not necessary to request a waiver for any tax return for which the DOR does not provide an electronic filing methodology such as Form 6230 Application for Quick Refund of Overpayment of Estimated Tax or Form 6900 Partnership Information Return* Note Under regulations adopted October 25 2015 Alaska requires any corporation to electronically file if that corporation is required to electronically file its federal return* See Alaska Regulation 15 AAC 20.150 155 for more details. The DOR will not grant a waiver if a corporation is subject to such federal There are two ways to file an Alaska corporate income tax return MeF Modernized E-File allows you to file your state return in conjunction with your federal tax return processing* This method requires the use of approved tax preparation software. Revenue Online ROL is the state portal for electronic filing. ROL provides for Standard Filing as well as Expedited Filing. Expedited Filing means that you will have a limited number of fields to enter similar to the reporting requirements of the old short form* To use Expedited Filing you must log on to your Revenue Online account and answer a short list of questions. If the corporation does not qualify for Expedited Filing Revenue Online will lead you through a complete Form 6000 Alaska Corporation Net Income Tax Return* Gas Storage Facility Tax Credit The Alaska Gas Storage Facility Tax Credit under AS 43.20.046 expired on December 31 2015. Therefore a taxpayer may not claim a new credit for expenditures after that date. Any credit previously granted may be carried forward however. A special checkbox has been added to indicate that the taxpayer is a Cooperative Association* If you have questions need additional information or require other assistance please call Juneau 907-465-2320 Anchorage 907-269-6620 Current tax forms and instructions are available online at www.tax.alaska*gov* To facilitate the processing of your return be sure to do the following 1 MeF Filers. If you are filing a return using Modernized E-File avoid common errors If the corporation is claiming any carryover items net operating losses capital losses etc* make sure your tax software supports Form 6385. Failure to fill out and transmit Form 6385 may result in denial of associated tax attributes. incentive credits make sure your tax software supports the relevant forms such as Forms 6310 6327 6328 6390 6395 . Failure to fill out and transmit required forms may result in denial of associated credits. Make sure that Schedule I shows factor numerators by corporation net of eliminations. Do not list an elimination company. Remember to attach a pdf to your submission for o Form 7004 to support your extension* o Required statement for other additions/subtractions. 2 File with the correct taxpayer name. If the Alaska taxpayer is a member of a federal consolidated group then the name on the Alaska return will often be different than the name on the federal return* See specific instructions on page 9 regarding name enter the name as it appeared in the prior return* If the name on this return is different from the name reported on the prior return then complete question 4 of Schedule B. 3 The water s edge combined reporting method is mandatory in Alaska for all corporations except oil and gas corporations. A separate-company tax return is not permitted* See Combined Report and Unitary Group or Unitary Business on pages 6 and 7 respectively. 4 Provide the name email address and phone number of a contact person who can answer any question that the DOR may have regarding the tax return* This must be an officer or employee who is authorized to answer any such questions. Generally the DOR cannot discuss taxpayer information with an outside party unless there is a Power of Attorney. See Paid Preparer Authorization on page 5. 5 If this is a consolidated Alaska return then you must complete Schedule B listing all members of the Alaska consolidated group except the taxpayer listed on page 1. Do not list all members of the federal consolidated group unless all of Schedule B is not fulfilled by attaching federal Form 851 data* 6 If this taxpayer and one or more other Alaska taxpayers are included in a consolidated federal return these same taxpayers must file a consolidated Alaska return if they are part of the same unitary group* 7 Attach a schedule as required by the forms. Schedules providing detail by company are required as explained in the instructions. Attaching complete schedules will ensure a valid filing and prevent unnecessary correspondence with the DOR* Be sure that attached schedules are properly referenced and agree to the totals reported on the form* 8 Attach a copy of the signed federal income tax return of the taxpayer as filed with the IRS* Do not attach a pro-forma return* Send only the portions of the federal return specified in the instructions on page 6 if the federal return exceeds 50 pages. 9 To avoid interest and penalties pay any tax when due see 30 days of the due date for the federal return* Note that the thirty days may or may not correspond to the 15th day of the following month. Every corporation having nexus with the state must file an Alaska Corporation Net Income Tax Return* Nexus sometimes referred to as doing business within the state is the act of conducting business activity within the state and may exist as a result of a corporation s direct activity the activity of its employees or agents or through its interest in a partnership or limited liability company. Nexus-creating activities may include but are not limited to 1 owning or using property in the state including leased or mobile property 2 presence of employees in the state for business purposes 3 making sales into the state or 4 the generation of income from sources within the state without regard to whether there is a physical presence in the state. An S Corporation doing business in Alaska is required to file an Alaska return but Alaska does not impose a tax on the S Corporation for pass-through items of income. Generally an S Corporation will satisfy its filing requirement by filing Form 6000 page 1 only checking the S Corporation box on page 1. Do not report amounts on Schedule A or any other pages unless a corporate-level tax is applicable. Attach a copy of pages 1 through 5 of the federal Form 1120S* Alaska imposes both the federal excess net passive income tax and the corporate-level tax on built-in gains. These taxes are calculated at the highest Alaska marginal tax rate of 9.4 . If and forms calculating the federal tax and the Alaska tax. Enter the Certain small corporations are exempt from Alaska corporate income tax. To qualify for the exemption a corporation and its affiliates must be a qualified small business meeting the requirements below described in Internal Revenue Code IRC Section 1202 e as that sub-section read on January 1 2012. This includes certain startup operations. The corporation s total assets including assets of all affiliates may not exceed 50 million* This is measured at the beginning of each tax year to determine if the corporation is eligible for the exemption for that tax year. Eighty percent determined by value of the corporation s assets including assets of all affiliates must be used in the active conduct of one or more qualified trades or businesses. However no more than 50 of working capital will count toward that total* A qualified trade or business is any business except the following Note that partnership income and factors are attributed to and combined with the income and factors of the corporate partner. Please see Alaska Regulation 15 AAC 20.320 for further information* Performance of services in health law engineering architecture accounting actuarial science performing arts consulting athletics financial services brokerage services or any other business where the principal asset of the business is the reputation or skill of one or more of its employees Caution A Publicly Traded Partnership PTP is generally taxed as a corporation and so must file Form 6000. A PTP does not file Form 6900 unless it files as a partnership for federal tax purposes. Banking insurance financing leasing investing or similar business Business involving production or extraction for which a depletion allowance could be claimed An LLC doing business in the state must file an Alaska tax return consistent with its federal tax status. If the LLC is characterized file a tax return in accordance with the instructions applicable to corporations. An LLC with corporate member s characterized as a partnership for federal income tax purposes must follow the Hotel motel restaurant or similar business or Construction transportation utility or fisheries business. Generally an exempt organization is subject to the Alaska under the Internal Revenue Code. If the organization files federal Form 990-T to report Unrelated Business Taxable Income UBTI with the IRS the organization must complete Form 6000 reporting the taxable income or loss and calculate any applicable Alaska tax. Attach a signed copy of Form 990-T. An exempt organization does not file an Alaska return if it is not required to file Form 990-T. Farming including timber Important Note All corporations which are members of the same parent-subsidiary controlled group are treated as a single corporation when determining whether a corporation is exempt as a Small Corporation* The controlled group includes any corporation connected through stock ownership with a common parent corporation if more than 50 percent of the total combined voting power of all classes of stock is owned by the parent or one or more of the corporations within the group* How to Claim Exemption as a Small Corporation A corporation that claims exemption under AS 43.20.012 a 3 must still file a complete Alaska corporate income tax return reporting all income and expenses on Form 6000 except that no tax is calculated* The following is required to claim the exemption 1 On page 1 in the Return Information section check the of pages 1 5 of the corporation s federal income tax return Form 1120 1120-F etc* as actually filed with the IRS* If the Form 1120 was not filed electronically the copy must be of the signed original return* If the Form 1120 was filed electronically you must include a copy of the appropriate Form 8453 or Form 8879 to show that the return was filed electronically. 2 You must attach a copy of federal Form 851 if the corporation was a member of a federal consolidated group* controlled group then you must attach a copy of SEC Form 20-F or other audited financial statements that readily discloses gross assets and the nature of business operations. A partnership doing business in the state having one or more Partnership Information Return along with supporting schedules and a copy of the signed federal Form 1065 pages 1 5. The partnership return is due 30 days after the federal due date of the Form 1065. See separate instructions for Form 6900. Certain income received by a regional aquaculture association or a salmon hatchery permit holder is exempt from tax under Alaska law. Thus the due date is not necessarily the 15th day of the month following the federal due date. Alert Because of recent federal law changes the due date for the Alaska corporate income tax return has changed in most cases. Changes are effective for tax years beginning after December 31 2015. Federal law now bases the due date on whether the taxpayer is a C Corporation an S Corporation or a special entity such as an Exempt Organization or Cooperative. There are also special rules for tax years that end in June. In addition the time period for federal extensions of time to file has also changed for some returns. See Extension of Time to File below. months after the end of the tax year are as follows Filing due date 15th of the fifth month Cooperatives all tax years See WHAT S NEW above for more details. date to 30 days after the federal extended due date. This is also true if the IRS extends a due date because of an event such as a natural disaster. You must check the applicable box on Form 6000 page 1 to report that a federal extension is in effect. An extension of time to file is not an extension of time to pay. The return must be signed by an authorized officer of the with the paid preparer who signed it check the applicable box in the signature area of the return* This authorization applies only to the preparer whose signature appears at the bottom of the return* It does not apply to the firm* If the applicable box is checked the corporation is authorizing the DOR to call the paid preparer to answer any questions that arise during the processing of the return* The corporation is also authorizing the paid preparer to 1 Call the DOR for information about the processing of the return or the status of any related refund or payment and Because of recent federal law changes the payment due date for 2015. As with filing due dates the payment due dates depend on whether the taxpayer is a C Corporation an S Corporation or a special entity such as an Exempt Organization or Cooperative. There are also special rules for tax years that end in June. 2 Respond to certain DOR notices about math errors offsets and return preparation* follows Form 774 Power of Attorney. o 15th of the fourth month o 15th of the third month o 15th day of the fifth month any refund check bind the corporation to anything including any additional tax liability or otherwise represent the corporation before the DOR* Payment of estimated tax is required as provided under IRC Section 6655. A corporation that fails to pay the proper estimated tax when due will be subject to an underpayment penalty for the period of underpayment. Form 6220 Underpayment of Estimated Tax by Corporations must be completed and attached to the return only if the corporation is relying on the Adjusted Seasonal Installment Method or the Annualized Income Installment Method. Otherwise Form 6220 is not required* See separate instructions for Form 6220. may apply for quick refund if the overpayment is Note that due dates for estimated tax payments have not changed* At least 10 of the expected tax liability and See instructions for Estimated Tax Payments below and Payment of Tax on page 7. At least 500 Filing Form 6230 does not fulfill a corporation s filing obligation* Mail the return with attachments to TAX DIVISION ALASKA DEPARTMENT OF REVENUE PO BOX 110420 JUNEAU AK 99811-0420 Two or more Alaska taxpayers included in the same federal consolidated return who are in the same unitary business must file a consolidated Alaska return* Additionally two or more taxpayers may elect to file a consolidated return if they qualify to join in a Foreign corporations are treated as domestic corporations for purposes of determining eligibility to file a consolidated Alaska return* If any two taxpayers join in filing a consolidated Alaska return all eligible taxpayers must be included in the consolidated return* Alaska consolidated returns resemble but do not mirror the federal consolidated return* In an Alaska consolidated return the contributions the dividends-received deduction income tax credits and other taxes. If a taxpayer is a member of an affiliated group then the taxpayer is required to determine its taxable income using the water s edge combined method of reporting. See Combined Report below. An affiliated group is a group of member of the group is owned directly or indirectly by one or more corporate or non-corporate common owner s or by one or more of the members of the group* comprise the consolidated Alaska return* and 6001 7872 with full force and effect unless excepted to or modified by other provisions of Alaska law. In addition AS 43.20.160 and AS 43.20.300 require the DOR to apply as far as practicable the administrative and judicial interpretations of the federal income tax law. Note that Alaska law does not adopt IRC Sections 1400 1400U which grant tax benefits for activities in certain geographic zones including those in Enterprise Zones and Gulf Opportunity Zones. If the taxpayer qualifies for special federal treatment under these code sections this may require that the taxpayer recompute some federal-based credits or deductions for Alaska purposes. complete copy of its signed federal income tax return Form 1120 1120S 990-T etc* . The copy must be of the return actually filed with the IRS for the same tax year. If the Alaska return is based on a combined report then a copy of the federal return filed by any of the members of the combined group must be attached* A pro-forma return will not fulfill this requirement. Failure to provide the required federal return s will result in the Alaska return being deemed incomplete and penalties may apply. If Form 1120 is electronically filed attach a copy of the appropriate Form 8453 or Form 8879 which must show the signature. Note If the federal return exceeds 50 pages a corporation may submit the following portions of the required federal return in lieu of the entire federal return 1 A copy of pages 1 through 5 of federal Form 1120 pages 1 through 5 of Form 1120S pages 1 through 7 of the Form 1120F etc* for the tax year. appropriate Form 8453 or Form 8879 signed as filed with the IRS* 3 If a consolidated federal return is filed attach copies of the schedules prepared for the computation of consolidated taxable income. The schedules must show the separate group with the consolidating eliminations and adjustments made to arrive at consolidated taxable income. 4 Schedules M-3 and supporting schedules. 5 Schedule D and supporting schedules. 6 Form 4797 and supporting schedules. 7 Credits If claimed on the Alaska return include copies of Form 3800 with applicable supporting federal forms and copies of federal forms supporting any credits not reported on Form 3800. 8 Extension Form 7004 if applicable. Federal tax return information can be filed in digital file format. Digital documents are accepted in .pdf or .tif format only on the following media CDs DVDs or thumb drives. All media must be physically labeled with Taxpayer Name EIN and tax year. If multiple discs or thumb drives are used they must be sequentially numbered* The federal tax return information should start with pages 1 through 5 of the federal tax return filed with the IRS* The DOR does not accept pro-forma returns. Whenever two or more corporations are engaged in a unitary business conducted within and outside Alaska the members of the unitary group that are Alaska taxpayers must apportion the combined income of the group to measure their Alaska taxable income. For all corporations except oil and gas corporations the water s edge combined reporting method is required it is not elective. A water s edge report generally combines only those members of the worldwide unitary group that 1 have a significant connection to or presence in the U*S* 2 are tax haven corporations as defined in AS 43.20.145 a 5 or 3 foreign corporations that have nexus with Alaska* In general a corporation has a significant connection to the U*S* if it has an average overall U*S* factor of at least 20 . To construct the water s edge combined group start with the taxpayer s worldwide affiliated group remove non-unitary affiliates then remove unitary affiliates that have less than 20 average U*S* factors except that tax haven corporations remain part of the combined group* The 20 U*S* factor threshold must be determined on a companyby-company basis and unlike the apportionment factor includes intercompany sales. or greater average U*S* factors must file a return using the water s edge method of reporting in which it is combined with all members Please refer to Alaska Regulation 15 AAC 20.300 to correctly report the income of any unitary foreign corporation that does business in Alaska or that meets the 20 U*S* factor threshold test. Note that the income of a foreign corporation is reported on the basis of the entire corporation which may not equal the income reported on the Form 1120-F* A business is unitary if the entities involved are under common direction formal or informal and activities within and without the state are contributory and complementary in nature such that profits of the group are inextricably related* Tests of unitary determination include functional integration centralized management and economies of scale. Determination of whether the activities constitute a unitary trade or business depends on the facts of each case. The following factors are considered to be indications of a unitary trade or business and the presence of any of these factors creates a presumption that the activities constitute a single trade or business. 1 Same type of business. Corporations are generally engaged in a unitary trade or business when the activities are in the same general line of business. For example corporations that operate a chain of retail grocery stores are almost always engaged in a unitary business. functional or the transactional test is business income. Income from transactions or activity that is unusual or infrequent is not considered non-business income solely because of the unusual or infrequent nature of the income activity or transaction* Non-business income is all income other than business income. Combined Periods Affiliates Having Different Accounting The income of all affiliates included in a combined report must be determined on the basis of the same accounting period. Generally the accounting period used in the return should be that of the common parent. Where no common parent exists the income of the combined affiliates should be determined on the basis of the taxpayer s annual accounting period. Generally when it is necessary to convert an affiliate to the annual accounting period of the taxpayer an interim closing of the books should be made for the members whose accounting period differs from the common parent and/or taxpayer. If no substantial misstatement of income results a pro-rata conversion may be used* 2 Steps in a vertical process. Corporations are engaged in in a vertically structured enterprise. For example corporations that explore for and mine copper ores concentrate smelt and refine the copper ores and fabricate the refined copper into consumer products are engaged in a unitary trade or business regardless of the fact that the various steps in the process are operated substantially independently of each other and with only general supervision from the executive offices. 3 Strong centralized management. Corporations that might otherwise be considered as engaged in more than one trade or business are engaged in one unitary trade or business when there is strong centralized management. Some indications of checks the P.L* 86-272 box on page 1 under Return Information* return except to sign the return* a the existence of centralized departments that perform the normal functions that a truly independent business would perform for itself such as accounting personnel insurance legal purchasing advertising or financing or b centralized executive officers who are involved in planning operations or coordination* A REIT that meets the 50 ownership test is required to be included in the combined group* The taxpayer may not claim an Alaska dividends-received deduction for the REIT dividends received if the REIT income is included in the combined report net of the dividends-paid deduction* If a corporation claiming P.L* 86-272 protection is a member of an on Schedule B line 1 and check the appropriate box on that line. group* That corporation will report no numerator values for property payroll or sales on Schedule I but will be included in the denominator. The corporation must be correctly listed on Schedule B to be considered as having made a protective Alaska filing. A taxpayer with business income attributable to sources within and outside Alaska must apportion such income. To calculate the apportionment factor use Schedule I Apportionment Factor. Alaska includes insurance companies in the combined group with apportionment factors calculated under Alaska Regulation 15 AAC 20.610. If an insurance company pays Alaska premium tax under AS 21.09.210 then that company is exempt from corporate income tax. This is accomplished by excluding that company s numerator values from the numerators of the combined group* Apportionment refers to the division of business income among states by the use of an apportionment formula* Allocation refers to the assignment of non-business income to a particular state. Alaska applies both the transactional and functional tests of business income. Income resulting from transactions or activities that are within the regular course of the taxpayer s trade or business are business income. Income from tangible or intangible property is business income if the acquisition management and disposition of the property constitute integral parts of the taxpayer s regular trade or business. Income meeting either the Payments can be conveniently made electronically using DOR s online-tax.alaska*gov* If you are a first-time taxpayer the system will require you to register. When an estimated tax payment is 100 000 or greater or a payment with a return is 150 000 or greater payment must be made through Revenue Online or by wire transfer see Alaska you choose to pay by check or wire transfer. ACH debit payments. Revenue Online does not accept ACH credit or credit card transactions. The taxpayer will register directly with Revenue Online. If a bank account has a debit block any online payment request will be rejected by the bank. Rejected payments may result in late payment penalties and interest. If a bank account has a debit block the taxpayer is encouraged to contact its bank before making an online payment to register the State of Alaska as an authorized ACH debit originator. The company ID for the Alaska Department of Revenue is 0000902050. A taxpayer making a payment by wire transfer is required to notify the State of Alaska Treasury Division by 2 00 p*m* the business day prior to the wire transfer settlement date. Prepare the payment voucher using Revenue Online and email to cashmgmt alaska* gov* If the payment covers multiple tax years prepare a separate voucher for each year. A check must be submitted with the appropriate tax return or payment voucher. Payment vouchers can be found on Revenue Online or you may use Form 6240. Mail check with return or payment voucher to any amendment of the taxpayer s federal income tax return or recomputation of tax by the IRS* The Alaska amended return must be filed with full payment of any additional tax within 60 days after the final determination of the federal adjustment to avoid assessment of a penalty for failure to file. If the date that the adjustment is finalized is later than the date on federal Form 4549 or 4549A the reason must be satisfactorily explained to avoid assessment of member of the combined group of the taxpayer. Note The taxpayer s obligation to report and pay additional tax resulting from adjustments to federal income tax liability is not affected by the expiration of the statute of limitations period for the taxpayer s original Alaska corporate tax return* A protective refund claim is filed to preserve the taxpayer s right to claim a refund when the taxpayer s right to the refund is contingent on future events and may not be determinable until after the statute of limitations expires. A protective refund claim is made by submitting an amended return checking the box for a protective claim and including a written statement that clearly identifies the basis for the claim as well as the contingency affecting the claim* Any claimed overpayment is not refunded until the matter is resolved* The DOR will treat the amended return as If it is necessary to amend your return while a protective claim is pending do not take into account changes reported on the Once the relevant matter is resolved the claim is perfected by filing a follow-up amended return which reports the Alaska tax liability as finally resolved* Alaska charges simple interest on taxes due at a rate which fluctuates each quarter. For current rates refer to our website at An amended return must be filed as a complete return* If you are amending a return for 2013 or later year the form has a checkbox on page 1 to indicate amended return* If you are amending a return for 2012 or an earlier tax year you must file a complete return and write Amended Return preferably in red across the top of the amended return* If you are amending your return to claim a carryover of tax attributes such as a net operating loss NOL capital losses or excess charitable contributions then you must attach Form 6385 Tax Attribute Carryovers. This form may also be used to claim a carryback of NOL or capital losses. If the federal return was also amended a complete copy must be attached* If the Alaska amended return claims a refund based on an amended federal return then you must attach documentation that the IRS has accepted the amended federal return* An amended Alaska return is also required if the federal return is adjusted by The DOR does not accept amended returns on Forms 611X or 611N* including extension is subject to a failure to file penalty of 5 of the unpaid tax for each 30-day period or portion of a period the return is late up to a maximum of 25 of the unpaid tax. subject to a failure to pay penalty of 5 of the unpaid tax for each 30 day period or portion of a period the payment is late up to a maximum of 25 of the unpaid tax. If during any period or portion of a period both the failure to file and failure to pay penalties are applicable only the failure to file penalty is imposed* not have a waiver is subject to a penalty of the greater of 25 or 1 of the tax due before application of payments. Alaska provides a Voluntary Disclosure Program to qualified taxpayers. The taxpayer must voluntarily come forward have never filed an Alaska corporate tax return have not been the subject of an inquiry from the DOR and meet other requirements. Certain penalties are waived but tax and interest must be fully paid* For additional information please see Form 6750 and the associated instructions. return* You must file a complete return to amend including all schedules. Do not mark schedules As originally reported* Be sure to attach a statement explaining the changes being reported* See instructions for related checkboxes below. Filing extension A federal extension automatically extends the Alaska filing due date. You must check this box to report that an extension is in effect. When this form was drafted the current year federal tax forms were not finalized* Therefore references to lines and schedules on federal forms may not be accurate. Nothing in these instructions or associated forms should be read to conflict with Alaska statutes or regulations. These instructions are presented to assist the taxpayer in preparing a corporate return for Alaska* Every effort is made to ensure that intended to address every legal situation* The taxpayer is advised to consult Alaska Statutes Title 43 Chapters 05 19 and 20 and related regulations and to consult a legal advisor. Enter the name and federal Employer Identification Number EIN of the taxpayer. If this is a consolidated Alaska return enter the name and EIN of one taxpayer included in the consolidated filing. Do not use the name of the federal consolidated group XXX If the common parent of the federal consolidated group is an Alaska taxpayer use its name and EIN on page 1. Otherwise select the taxpayer with the largest Alaska presence. Continue to use that name and EIN for subsequent tax periods until the taxpayer leaves the Alaska consolidated group or the common parent becomes an Alaska taxpayer. If this taxpayer or consolidated group has previously filed under the name and EIN of a common parent not having nexus in Alaska change the designated taxpayer according to these instructions and complete Schedule B question 4. individual to whom correspondence regarding this return should be directed* This must be an officer or employee authorized to receive confidential tax information* Generally the DOR cannot discuss tax matters with an outside party unless there is a Power of Attorney see Paid Preparer Authorization on page 5 . Check all boxes that apply. Final Alaska return Check this box if you do not expect to have nexus in Alaska after this tax year. Note If you intend to check Final due to a corporate reorganization please contact the DOR at 907 269-6632 for technical assistance. being filed by two or more Alaska taxpayers. Consolidated applies to the Alaska taxpayers not their federal return status. Note that a consolidated return is required in some cases. See Carryback is waived for Net Operating Loss Check this box if the tax return shows a net operating loss on Schedule A line 1 and you are electing to waive the carryback period. This election is state-specific a federal waiver is not effective. The election is made for the entire net operating loss a partial election is not allowed* The election must be made on a timelyfiled return including extensions . Alaska follows federal rules where a taxpayer wants to make a late election or to revoke an election as applicable. Public Law 86-272 applies P.L* 86-272 Check this box if the 86-272. If this is a consolidated return and another Alaska corporation is claiming protection under P.L*86-272 then that See Public Law P.L* 86-272 discussion on page 7. HOA filing Form 1120H If the corporation is a Homeowners Association HOA filing federal Form 1120H then check this box. If the HOA is filing federal Form 1120 then do not check this box. is claiming exemption from tax under AS 43.20.012 a 3 . To be exempt the corporation must meet certain asset limit requirements and its principal business must not be in certain industries. The corporation must file a complete Alaska tax return reporting all income and expense items but does not calculate Alaska income tax on Schedule D and does not report Other Taxes on Schedule E* If the corporation is federal Form 851 to the Alaska return* See Small Corporation Exemption on page 3 for further details. Unrelated Business Taxable Income UBTI then check this box. If the organization does not report any UBTI then the S Corporation Check this box if the corporation is an S Corporation under federal law. Personal Holding Company Check this box if the corporation is a Personal Holding Company as defined in IRC Section Cooperative Association Check this box if the corporation this box if this is an amended return to report audit changes by the IRS or the filing of an amended federal tax return Form 1120X . You must attach a complete copy of the federal audit report RAR showing federal changes by company along with federal documentation showing that the changes are final* If this is a refund claim based on an amended federal tax return attach documentation that the federal amendment has been accepted by the IRS* Line 16 Overpayment credited to estimated tax This is a binding election and the overpayment cannot be re-applied or reduced at a later date. See federal Treas* Reg* 301.6402-3 a and d . statement explaining the protective claim* See additional If this is an amended return filed to report an additional overpayment in excess of the overpayment reported on the original return then you can make the election to carry the additional overpayment to the next succeeding year only if the amended return is filed before true if the original return did not report an overpayment but the Line 2 Alaska net operating loss NOL deduction If there is Alaska taxable income reported on line 1 then enter the amount of NOL to be utilized in the current year in the space provided on line 2. Form 6385 Tax Attribute Carryovers must be attached to claim NOLs being carried forward from previous years. year after 2016 enter the amount of carryback to be utilized in the space on line 2. Use Form 6385 to identify the loss years. Do not enter the federal net operating loss deduction* The Alaska net operating loss deduction may differ from the federal net income differences between the federal consolidated group and loss apportioned to other states. The application of an Alaska net operating loss is governed by applicable Internal Revenue Code provisions. Line 7 Alaska incentive credits Enter amount from Form 6300 line 44 to report Alaska incentive credits that are not refundable credits. This includes the Income Tax Education Credit. Line 11 Alaska credit for prior year minimum tax The Alaska credit for prior year minimum tax AMT credit is based on the federal AMT credit multiplied by 18 and apportioned if appropriate. The Alaska credit may not exceed the cumulative Alaska alternative minimum tax previously paid to Alaska since the 1987 tax year net of prior year Alaska AMT credit previously applied* For further details please refer to Alaska Regulation 15 AAC 20.135 f and g . Use the worksheet below to calculate the amount of Alaska AMT credit allowable in the current year. You must complete and attach 1. Credit for prior year minimum tax from Form 1120 Schedule J attributable to the combined group 2. Multiply line 1 by 18 4. Apportioned tentative credit. Multiply line 2 by line 3 from line 10 of Form 6385 Tax Attribute Carryovers. line 4 or 5. Enter here and on Schedule A line 11 Line 1 Alaska taxpayer information This schedule must be completed if the Alaska return is a consolidated return* List each member of the Alaska consolidated group on Schedule B line 1 except the taxpayer shown on page 1. If the corporation is claiming protection under P.L* 86-272 or is exempt as an Alaska insurance company pays Alaska premium tax under AS 21.09.210 then check the appropriate box next to that corporation s name on line 1. Otherwise check the boxes indicating which activities of corporations on Schedule B must agree to the corporations reporting Alaska factors on Schedule I except those corporations companies. is joining in filing an Alaska consolidated return as a protective measure then that corporation must be properly listed on Schedule B to effect a protective filing. Caution If Schedule B is not properly completed then the DOR may determine that a particular corporation doing business in Alaska has not filed a tax return and may subject the corporation Do not list affiliated corporations that are not Alaska taxpayers. Replicating the federal Form 851 information does not constitute a properly completed Schedule B. If Alaska activity is conducted by a Disregarded Entity then its activity is attributed to its corporate owner. List that corporate owner on Schedule B not the Disregarded Entity. Do not list a partnership on Schedule B report the corporation holding that partnership interest. Enter the dates and amounts of estimated tax payments made different from the taxpayer shown on page 1 identify the payer by notation in the area below the Estimated Payments section* Total payments must equal Schedule A line 10. only to account for payments made and refunds received based on the original return or as last amended or adjusted by the DOR* If you are claiming exemption as a Small Corporation see page 3 do not complete Schedule D. Line 2 Net capital gain Enter amount from Schedule J line 18 not to exceed line 1. You may not claim the special capital gains tax rate of 4.5 unless capital and Section 1231 gains are properly reported on Schedule J* Line 4 Tax on ordinary income Use the Tax Rate Table to compute the tax on line 4. The tax rate table is on page 1 of these corporation must calculate its tax on Schedule D using the graduated rates in addition to the 12.6 add-on tax that is reported on Schedule E line 4. Line 1 Alternative Minimum Tax AMT In column A report the amount of the federal AMT that is applicable to the water s edge combined group from federal Schedule J* Multiply the amount in column A by 18 and enter the result in column B. Line 4 Personal Holding Company PHC tax Report the PHC tax of 12.6 apportioned if appropriate. This tax is assessed in addition to tax calculated at ordinary tax rates on Schedule D. Line 5 Increase in tax liability due to cessation of commercial operations of a liquefied natural gas storage facility under AS 43.20.047 h Use Form 6323 to calculate the increase in tax liability and attach to the tax return* Line 6 Other taxes Report on line 6 any other federal taxes or Internal Revenue Code under AS 43.20.021 a . In addition use this line to report other taxes and additions to tax liability required under other Alaska tax statutes. Such taxes include but are not limited to Lines 2a 2g Taxpayers using the combined method of reporting water s edge taxpayers must complete lines 2a 2g. These lines of Schedule H report the income of the corporations that are added to or removed from those included in line 1 to arrive at the net income before modifications of the water s edge group* Skip directly to line 3 if the taxpayer is not required to use the combined method of reporting. Line 2a Enter the FTI reported on the federal tax return s of all domestic unitary corporations not included in line 1 with 20 or greater U*S* factors. Attach a schedule by company. water s edge group* Include any foreign corporation with 20 or The income of a foreign corporation is the taxable income before subject to modification under Alaska law as if the corporation were a domestic corporation* Alternatively the taxpayer may elect to report the book income of the foreign corporation or its Earnings and Profits as reported on federal Form 5471. Please refer to 15 AAC 20.300 e and f for further information* Note that the income of the foreign corporation must be reported for the entire corporation* The corporation may not report federal 1120-F includes all income of the corporation* Line 2c Enter income reported by tax haven corporations. Also use this line to report the foreign sales corporation s profit including federally exempt foreign trade income and allowing for deductions attributable to exempt foreign trade income. Line 2d Remove the income or loss of companies included in line 1 that are not included in the unitary business of the taxpayer s . Look-back interest is based on federal interest rates and apportioned to Alaska 18 does not apply . Attach a copy of federal Form 8866 or 8697 as applicable. 1 that are part of the taxpayer s unitary business but whose U. S* factors average less than 20 . Attach a schedule by company. Recapture of federal low-income housing credit must be multiplied by 18 and apportioned if applicable. Attach a copy of federal Form 8611. are necessary to reflect the combined income of the water s edge in lines 1 through 2e may or may not include adjustments to or the elimination of intercompany profits as required under the combined method of reporting. An intercompany transaction of a federal consolidated group may not be an intercompany transaction of the water s edge group* This may include the reversal of a consolidating elimination or adjustment from the adjustment for inter-group transactions that are not reflected in the income reported on lines 1 or 2a 2e or a combination of the two. Recapture of Alaska investment tax credit is subject to federal recapture rules to the extent that the investment originally generated an Alaska investment tax credit. The subject amount is then multiplied by 18 but is not apportioned* net passive income taxes. Attach a statement showing the tax calculation and apportionment if applicable. Line 1 Enter the federal taxable income or loss before deductions for federal net operating loss and federal dividendsreceived deduction FTI . Generally this will be line 28 of the Taxpayers included in a consolidated federal return should enter the FTI of the federal consolidated return on line 1 of Schedule H. 2a 2g and enter the amount from line 1 on line 3. Alaska regulations provide that intercompany transactions between any two members of the combined group if those two members join in a consolidated federal return must be accounted for in the combined report in the same manner as the transaction is accounted for in the consolidated federal return* Refer to Alaska The most common adjustment is for intercompany profits residing in beginning and ending inventory. Reverse end-of-year intercompany profit eliminations between corporations within and outside of the water s edge group to the extent they are included in the measure of income reported on lines 1 through 2e. Reverse beginning-of-year intercompany profits on transactions between they were not reversed in the measure of income reported on lines 1 through 2e. Line 4e Enter the amount of expenditures that are being claimed for the Qualified Oil and Gas Service Industry Expenditure Credit from Form 6327 line 2. required under AS 43.20.053 c . Line 6b Enter the dividends paid by members of the water s edge combined group to other members of the combined group intercompany dividends . Do not enter dividends between the federal consolidated return* Also see instructions for Schedule L on page 13. Line 6f Enter any non-business income or loss claimed and attach schedule by category of income. Enter on line 4b expenses incurred to produce non-business income. You must attach a schedule of all non-business income claimed by type of income and by company name. Line 6g Enter amount of capital gain income from federal Form 1120 line 8 reported by members of the combined group* Do not include any capital gain income excluded as non-business income on line 6f* taxable as ordinary income from federal Form 4797 line 12. Do not enter federal accumulated nonrecaptured net Section 1231 losses from prior years Form 4797 line 8 . Line 8 Enter apportionment factor from Schedule I line 14. Line 9 Multiply line 7 times line 8 to calculate apportioned income. Line 10 Enter non-business income or loss allocated to Alaska and attach schedule by category of income. gains and losses from Schedule J line 20. deduction from Schedule K line 10. elimination company. If lines 1 5 and 9 are improperly completed regarding eliminations this may result in a tax adjustment. If the taxpayer does business only in Alaska enter 1.000000 on line 14. If the taxpayer has business activity both within and outside of Alaska then Schedule I must be fully completed* Note that the list of taxpayers listed on lines 1 5 or 9 must match the list of taxpayers listed on Schedule B plus the taxpayer named on page exemption under P.L* 86-272 or Alaska insurance companies. entity is disregarded for Alaska purposes. On Schedule I list the business in Alaska then the partnership s apportionment factors property sales and payroll are attributed to that corporate partner. On Schedule I report the corporation s property payroll and sales including its share of partnership factors. Do not list the name or EIN of the partnership on lines 1 5 or 9. Taxpayers using the combined method of reporting are required to include a schedule of the calculation of the apportionment formula in columnar format disclosing for each corporation the total payroll and sales. All factor calculations lines 4 8 12 and 14 must be rounded to the sixth decimal place. If both the numerator and denominator for a particular factor are zero disregard that factor and divide line 13 by the remaining number of factors and enter the result on line 14. Property Factor See 15 AAC 19.141 202. The property factor is a fraction the numerator of which is the value of real and tangible personal property owned or rented and used within Alaska during the tax year to produce business income. The denominator is the value of all real and tangible personal property owned or rented and used to generate business income. Rents do not include royalties or amounts paid for services or supplies in Property used in the production of non-business income is not the factor. deduction as limited under IRC Section 246. Use the worksheet in Appendix B to calculate the allowable deduction and enter the amount on line 11c* Owned property is valued at its original cost averaged over the tax year. In general original cost is the unadjusted basis for subsequent additions improvements or partial dispositions. The average value of owned property is computed by averaging the property is valued at eight times the annual rents paid* Payroll Factor See 15 AAC 19.211 241. entire group of corporations with nexus in Alaska* Do not list list all corporations included in the federal consolidated group* If Schedule I is not properly completed this may delay the processing of the return and a delay in a refund. Additionally the DOR may deny interest on a refund claimed on a return that was not processible. The numerator values on lines 1 5 and 9 must be listed by The payroll factor is a fraction the numerator of which is the compensation paid within Alaska during the tax year to produce during the tax year to produce business income. The term compensation means wages salaries commissions and any other form of remuneration paid directly to employees for personal services. Payments made to an independent contractor or to any person not properly classified as an employee are excluded* Sales Factor See 15 AAC 19.251 302. The sales factor is a fraction the numerator of which is the gross receipts derived during the tax year from transactions and activities attributable to Alaska in the regular course of the taxpayer s trade or business. The denominator is the total gross receipts derived course of the corporation s trade or business. and Losses Schedule J is used to calculate the taxpayer s Alaska net capital gain* Gains and losses are measured after allocation and before any federal limitations according to their character. enter total gains and losses on lines 1 5 and 11 and enter nonbusiness capital gain or loss on lines 6 and 12 as appropriate. Enter the portion of non-business gain or loss that is allocable to Alaska on lines 8 and 14 as appropriate. Taxpayers using the of the entire combined group* Note If you are filing an amended return Schedule J must be fully completed based on information from federal Schedule D without regard to federal capital loss carryovers or carrybacks and Form 4797. Do not report amounts net of federal capital loss carryovers or carrybacks. losses from federal Form 4797 line 7 attributable to the combined group* Do not use the amount from Form 4797 line 17 which includes ordinary gains and losses. Line 2 The taxpayer s Alaska non-recaptured net Section 1231 losses are based on the apportioned Section 1231 gains and losses in prior years and may not correspond to the taxpayer s federal non-recaptured net Section 1231 losses. lines 1 5 attributable to the combined group* Do not use line 7 which includes federal unused capital loss carryover. See line 9 instructions below to report Alaska unused capital losses. Line 9 Enter on line 9 the Alaska excess capital loss to be utilized in the current year. The Alaska excess capital loss is the taxpayer s allocated and apportioned net capital losses from prior years. Enter in the first space on line 9 the amount from Form 6385 Tax Attribute Carryovers line 12. Do not enter the taxpayer s federal capital loss carryover from federal Schedule D. Special capital loss carryback notes If this is an amended return filed to claim a capital loss carryback enter the amount of carryback to be utilized in the current year in the space provided on line 9. This generally comes from Form 6385 line 16. Note that the allowable capital loss carryback. In this situation you would prepare the return with the following steps 1. Schedule H Alaska Income through line 10 2. Schedule J capital gains/losses including capital loss carryover to current year but excluding capital loss carryback 3. Schedule K charitable contributions 4. Schedule L dividends-received deduction 5. Calculate as-if Alaska taxable income Schedule A line 1 using items 1 4 above. If as-if taxable income is greater than zero then a capital loss carryback may be partially or fully allowable 6. Enter the allowable capital loss carryback in the space provided 7. Complete the remainder of the return* from Schedule D the sum of lines 8 10 plus lines 12 14 . Do not use the amount from line 15 as it includes Section 1231 gains and losses which must be reported on Schedule J line 1. Line 17 If line 10 is a gain and line 16 is a loss offset the loss from line 16 against the gain from line 10 and enter the result on line 17 but not less than zero. from line 10 against the gain from line 16 and enter the result on line 18 but not less than zero. This is the taxpayer s net capital gain* Enter the taxpayer s net capital gain on line 2 column A of Schedule D. Line 20 Add lines 17 18 and 19 and enter the result on Schedule H line 11a* The taxpayer s Alaska charitable contribution deduction may differ from its federal charitable contribution deduction as a result of Income Tax Education Credit contributions and differences in carryover values. Schedule K is used to measure the taxpayer s Alaska charitable contribution deduction limited by its Alaska any federal deduction limitations and exclusive of any federal excess contribution carryover. Line 2 Enter charitable contributions that were used to generate Form 6310 line 5. Line 2 should not exceed 9 800 000. from prior years from line 18 of Form 6385 Tax Attribute Carryovers. Enter as a positive number. Line 8 Enter the Alaska taxable income for deduction limitation purposes. Use worksheet in Appendix A to calculate the limitation and to calculate the amount of charitable contribution carryover to convert to net operating loss if applicable. The Alaska dividends-received deduction is based on the allocated and apportioned dividends included in Alaska taxable income and is limited to Alaska taxable income in accordance with IRC Section 246 b . Lines 2a 2d Enter the amounts of dividends already deducted or accounted for on Schedule H that are included in Schedule L line 1. These would include intercompany dividends Section 78 gross-up foreign dividends and dividends deducted on Schedule H as non-business income. These dividends are not eligible for a dividends-received deduction because they have already been deducted* Lines 8 and 9 Enter the allocated and apportioned dividends from line 7 according to the appropriate deduction percentage in accordance with IRC Sections 243 247 in column A of line 8 and multiply across. Enter the sum of line 8a d column C in line dividends allowable based on Alaska taxable income IRC Section 246 . Carry the amount of allowable dividend-received deduction Appendix A Worksheet for Charitable Contribution Deduction Taxable income for deduction limitation Enter sum of Schedule H lines 9 11a taxable income before charitable contribution but not less than zero Enter amount of capital loss carryback utilized included in Schedule J line 9 Is there a Net Operating Loss carryforward available to reduce taxable income in the current year Yes No If you answered no STOP. Enter amount from line 3 on Schedule K line 8 NOL carryforward available from Form 6.

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 2015 alaska income online

How to fill out and sign 2015 alaska 6000i online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax period started unexpectedly or maybe you just misssed it, it could probably cause problems for you. AK 6000i is not the easiest one, but you have no reason for panic in any case.

Utilizing our convenient online sofware you will see the right way to fill AK 6000i even in situations of critical time deficit. You simply need to follow these easy recommendations:

-

Open the record with our advanced PDF editor.

-

Fill in all the details required in AK 6000i, using fillable lines.

-

Insert photos, crosses, check and text boxes, if needed.

-

Repeating info will be added automatically after the first input.

-

In case of misunderstandings, use the Wizard Tool. You will see useful tips for simpler completion.

-

Do not forget to add the date of application.

-

Make your unique e-signature once and place it in the required lines.

-

Check the details you have included. Correct mistakes if needed.

-

Click on Done to complete editing and select how you will deliver it. You have the ability to use online fax, USPS or electronic mail.

-

It is possible to download the file to print it later or upload it to cloud storage like Google Drive, Dropbox, etc.

Using our powerful digital solution and its useful tools, completing AK 6000i becomes more handy. Don?t wait to use it and have more time on hobbies rather than on preparing files.

How to modify 2019 alaska: customize forms online

Check out a single service to handle all of your paperwork with ease. Find, modify, and complete your 2019 alaska in a single interface with the help of smart instruments.

The days when people needed to print out forms or even write them by hand are long gone. These days, all it takes to find and complete any form, like 2019 alaska, is opening a single browser tab. Here, you can find the 2019 alaska form and customize it any way you need, from inserting the text directly in the document to drawing it on a digital sticky note and attaching it to the document. Discover instruments that will streamline your paperwork without additional effort.

Click the Get form button to prepare your 2019 alaska paperwork quickly and start editing it instantly. In the editing mode, you can easily fill in the template with your details for submission. Just click on the field you need to change and enter the data right away. The editor's interface does not demand any specific skills to use it. When done with the edits, check the information's accuracy once again and sign the document. Click on the signature field and follow the instructions to eSign the form in a moment.

Use Additional instruments to customize your form:

- Use Cross, Check, or Circle instruments to pinpoint the document's data.

- Add text or fillable text fields with text customization tools.

- Erase, Highlight, or Blackout text blocks in the document using corresponding instruments.

- Add a date, initials, or even an image to the document if necessary.

- Utilize the Sticky note tool to annotate the form.

- Use the Arrow and Line, or Draw tool to add graphic components to your document.

Preparing 2019 alaska paperwork will never be complicated again if you know where to search for the suitable template and prepare it easily. Do not hesitate to try it yourself.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing 2015 alaska latest

Reduce document preparation complexity by getting the most out of this helpful video guide. Prepare your 2015 alaska 6000 in a few simple steps. Get accurate templates in the easiest way online.

2015 ak latest Related content

-

A highly stretchable, transparent, and conductive...

Science Advances 10 Mar 2017: Vol. ..... and Santa Cruz Biotechnology, Inc. SEBS with 20%...

Learn more -

Forms - Alaska Department of Revenue - Tax...

6000i, Alaska Corporation Net Income Tax Return Instructions, (Rev 4/9/19) ... 6100...

Learn more -

LG 60PN5700 User Manual Guide NC4 HM U P03 130709...

Jul 10, 2013 - The contents of this guide are subject to change without prior notice for...

Learn more

Related links form

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to 2015 6000i income

- 2015 instructions net

- 2017 alaska

- 2015 corporation latest

- 2015 corporation net

- 2015 6000i

- 2015 6000 income

- 2019 ak

- 2015 ak uslegal

- 2015 ak income

- 2015 6000i instructions

- 2015 6000 corporation

- ak 6000 form

- alaska form 6000 instructions 2022

- travelmarvel canada and alaska 2015

- food corporation of odisha recruitment 2015

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.