Loading

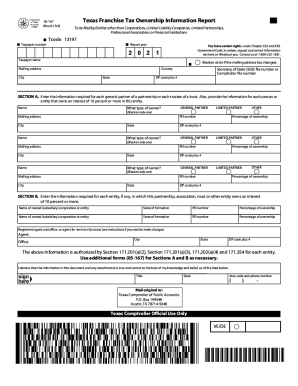

Get Tx Comptroller 05-167 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-167 online

This guide provides step-by-step instructions on how to complete the TX Comptroller 05-167 form online. By following these directions, users will be able to fill out the form accurately and efficiently.

Follow the steps to successfully complete the TX Comptroller 05-167 form online.

- Press the ‘Get Form’ button to access the TX Comptroller 05-167 form and open it for editing.

- Review the introductory information provided in the form to understand its purpose and requirements.

- Begin filling out your identifying information in the designated fields, ensuring accuracy as this is essential for processing.

- Proceed to the next sections, which may require additional details such as financial information or specific disclosures relevant to your situation.

- Double-check all entries for accuracy and completeness before submitting the form.

- Once finished, you can choose to save your changes, download a copy for your records, print the form, or share it as needed.

Start completing your TX Comptroller 05-167 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

All taxable entities must file a franchise tax report, regardless of annual revenue. The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.