Loading

Get Mi Dot 4580 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4580 online

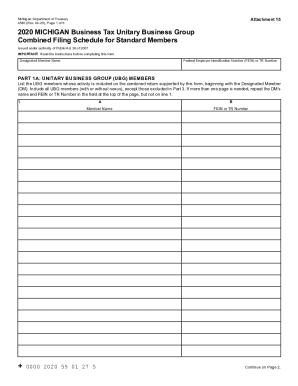

Filling out the MI DoT 4580 form online can seem daunting, but with clear guidance, it becomes a manageable process. This form is essential for businesses in Michigan to report their Unitary Business Group data accurately. Follow this comprehensive guide to ensure you complete each section correctly.

Follow the steps to fill out the MI DoT 4580 online efficiently.

- Press the ‘Get Form’ button to access the MI DoT 4580 form in the online editor.

- Enter the designated member's name and Federal Employer Identification Number (FEIN) or TR number in the provided fields.

- For Part 1A, list all members of the Unitary Business Group, beginning with the designated member. Ensure to include all members without exception, unless specified otherwise.

- Complete Part 1B for each member listed in Part 1A, including their member name, FEIN or TR number, organization type, street address, and other required details.

- In Part 2A, enter detailed financial data for each member, such as gross receipts, inventory, and other relevant metrics essential for the combined return.

- For each page of the form, ensure that the data is entered accurately and completely before proceeding to the next section.

- Once all parts are filled out, review the information for any possible errors or omissions. This will help avoid processing delays.

- After final checks, you can save changes, download, or print the form for your records, and then share it as needed or submit it according to the filing instructions.

Complete the MI DoT 4580 form online today to ensure your business complies with Michigan tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

New Schedule 3: (Nonrefundable Credits) These include the credits for higher-education expenses, child and dependent care expenses, adoption expenses, retirement savers, residential energy-saving expenditures, electric vehicles, and foreign taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.