Loading

Get Mi Dot 4582 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4582 online

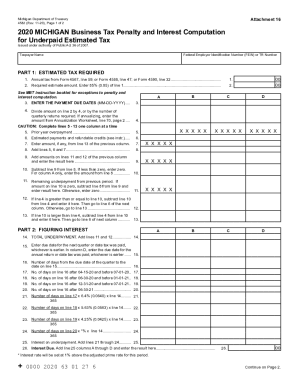

The MI DoT 4582 form is essential for calculating the penalty and interest for underpaid estimated tax in Michigan. This guide will provide users with a step-by-step approach to filling out the form correctly and efficiently online, ensuring compliance with tax requirements.

Follow the steps to complete the MI DoT 4582 with ease.

- Press the ‘Get Form’ button to access the MI DoT 4582 form and open it in your preferred online editor.

- Complete the Taxpayer Name section by entering the name of the individual or business responsible for the tax obligation.

- Fill in the Federal Employer Identification Number (FEIN) or TR Number to identify your business for tax purposes.

- Move to Part 1 and enter the annual tax from the specified forms (Form 4567, 4588, or 4590) on line 1.

- For line 2, calculate and enter 85% of the amount from line 1.

- Enter the applicable payment due dates in MM-DD-YYYY format on line 3.

- Calculate the estimated tax for each quarter and enter the value on line 4. Adjust accordingly if your business operated less than 12 months.

- Complete lines 5 through 9 one column at a time, entering relevant prior year overpayment amounts, estimated payments, and refundable credits.

- Proceed to Part 2 to calculate the interest due. Follow each line's instructions carefully as interest calculations are specific to each quarter.

- Next, move to Part 3 to determine any penalties. Answer the prompts according to your situation to avoid unnecessary penalties.

- If applicable, complete Part 4 for annualization if your income varies significantly throughout the year.

- Once all sections are completed, ensure you save your changes. You can then download, print, or share the form as needed.

Ensure compliance and accuracy by completing the MI DoT 4582 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If you are printing and mailing your Michigan return, you would need to attach your form W-2 and any W-2Gs or 1099-Rs that have withholding. TurboTax should print filing instructions with specific directions on how to file a printed return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.