Loading

Get Mi Dot Mi-1040cr-2 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT MI-1040CR-2 online

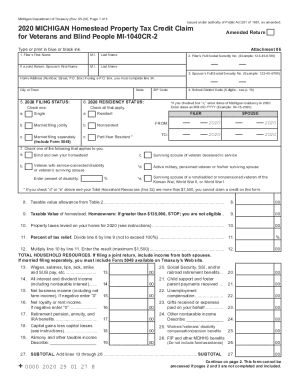

This guide provides clear and detailed instructions for completing the MI DoT MI-1040CR-2 online, a form designed for individuals seeking a homestead property tax credit in Michigan. Follow the outlined steps to ensure your submission is accurate and compliant with state requirements.

Follow the steps to successfully complete the MI DoT MI-1040CR-2 online.

- Press the ‘Get Form’ button to access the MI DoT MI-1040CR-2 form for online completion.

- Begin with the filer’s information, entering first name, middle initial, and last name. If applicable, include the spouse’s first name, middle initial, and last name as well.

- Fill in the full Social Security numbers for both the filer and the spouse.

- Provide your current home address, ensuring all fields including city, state, and ZIP code are completed accurately.

- Select the appropriate filing status for the year 2020 by checking one of the provided options.

- Indicate your residency status for the year 2020 by checking the relevant box. If applicable, include the dates of Michigan residency.

- Complete section 7 by checking all applicable boxes that pertain to your personal situation as it relates to blindness, veteran status, or active military service.

- Input the taxable value allowance as determined from the relevant table.

- Enter the taxable value of your homestead, noting the eligibility requirements regarding property value.

- List the property taxes levied against your home for the year 2020.

- Calculate the percent of tax relief by dividing the taxable value allowance by the taxable value, ensuring it does not exceed 100%.

- Multiply the property taxes by the calculated percent of tax relief and enter the result, observing the maximum limit.

- Compile your total household resources by listing various income sources, ensuring to separate income from both spouses where applicable.

- Subtract any adjustments from your subtotal to arrive at your final total for household resources.

- Proceed to line 33 to determine your property tax credit based on your total resources and applicable guidelines.

- Complete any necessary property reports for homeowners who moved in 2020, ensuring all details are entered.

- If applicable, fill out the renters section with all required details regarding rented homesteads.

- Finalize your form by checking for accuracy, saving your changes, and selecting options to download, print, or share the completed form.

Complete your MI DoT MI-1040CR-2 form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In general, the credit is higher when income is lower and/or when rent or property taxes are higher. The maximum Homestead Credit is $1,168.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.