Loading

Get Mi Mi-1040d 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-1040D online

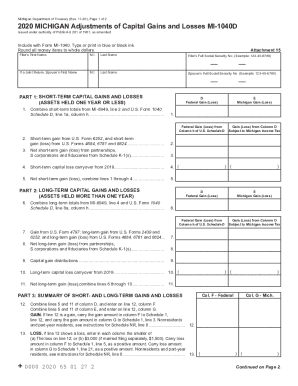

Filling out the MI MI-1040D is an important step for individuals looking to adjust their Michigan taxable income concerning capital gains and losses. This guide provides clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to complete the MI MI-1040D accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your first name, middle initial, and last name in the appropriate fields. If filing jointly, enter your partner's first name, middle initial, and last name as well.

- Input the full Social Security number for both yourself and your partner if applicable. Use the format: 123-45-6789.

- Navigate to Part 1 of the form, which covers short-term capital gains and losses. Combine the totals from MI-8949 and U.S. Form 1040 Schedule D as instructed.

- In column D, report the federal gain or loss; in column E, report the Michigan gain or loss from the data gathered.

- Proceed to Part 2, which addresses long-term capital gains and losses. Repeat the process of combining totals and entering data into columns D and E.

- Move to Part 3 to summarize both short- and long-term results. Calculate the totals and fill in the corresponding lines based on whether you incurred gains or losses.

- Complete Part 4 for computing capital loss carryovers. Make sure to follow the calculations correctly and enter the results in the designated columns.

- Once all fields are filled out and double-checked, save changes to the document and explore options to download, print, or share the completed form.

Complete your MI MI-1040D online today for an accurate adjustment of your capital gains and losses.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If your state of residence is Michigan and you are mailing a federal tax return/Form 1040 without a payment, you will mail it to Department of the Treasury Internal Revenue Service Fresno, CA 93888-0002.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.