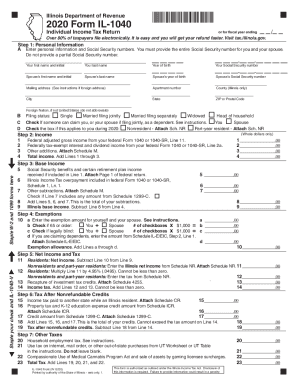

Get Il Dor Il-1040 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IL DoR IL-1040 online

How to fill out and sign IL DoR IL-1040 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Experience all the key benefits of completing and submitting documents online. Using our service filling in IL DoR IL-1040 usually takes a matter of minutes. We make that achievable through giving you access to our feature-rich editor capable of altering/correcting a document?s initial text, inserting unique fields, and putting your signature on.

Execute IL DoR IL-1040 in just several moments by following the recommendations listed below:

- Choose the document template you will need from the collection of legal forms.

- Click on the Get form button to open the document and begin editing.

- Complete the required fields (these are yellowish).

- The Signature Wizard will allow you to put your electronic autograph as soon as you?ve finished imputing details.

- Add the relevant date.

- Look through the entire template to make certain you?ve filled out everything and no corrections are needed.

- Press Done and save the ecompleted document to the gadget.

Send your IL DoR IL-1040 in a digital form as soon as you finish completing it. Your data is securely protected, because we adhere to the latest security standards. Become one of numerous satisfied clients that are already filling in legal templates from their homes.

How to modify IL DoR IL-1040: customize forms online

Get rid of the mess from your paperwork routine. Discover the simplest way to find and edit, and file a IL DoR IL-1040

The process of preparing IL DoR IL-1040 needs precision and attention, especially from people who are not well familiar with this type of job. It is important to find a suitable template and fill it in with the correct information. With the right solution for processing paperwork, you can get all the instruments at hand. It is simple to streamline your editing process without learning additional skills. Locate the right sample of IL DoR IL-1040 and fill it out immediately without switching between your browser tabs. Discover more tools to customize your IL DoR IL-1040 form in the editing mode.

While on the IL DoR IL-1040 page, click on the Get form button to start editing it. Add your details to the form on the spot, as all the essential instruments are at hand right here. The sample is pre-designed, so the effort required from the user is minimal. Just use the interactive fillable fields in the editor to easily complete your paperwork. Simply click on the form and proceed to the editor mode right away. Fill in the interactive field, and your document is good to go.

Try more tools to customize your form:

- Place more textual content around the document if needed. Use the Text and Text Box tools to insert text in a separate box.

- Add pre-designed visual components like Circle, Cross, and Check with respective tools.

- If needed, capture or upload images to the document with the Image tool.

- If you need to draw something in the document, use Line, Arrow, and Draw tools.

- Try the Highlight, Erase, and Blackout tools to customize the text in the document.

- If you need to add comments to specific document sections, click the Sticky tool and place a note where you want.

Often, a small error can wreck the whole form when someone completes it by hand. Forget about inaccuracies in your paperwork. Find the samples you require in moments and finish them electronically via a smart editing solution.

Get form

Related links form

600 N. Robert St. When mailing your return, you must include a copy of your federal income tax return (including schedules) and any income tax returns you filed with other states.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.