Loading

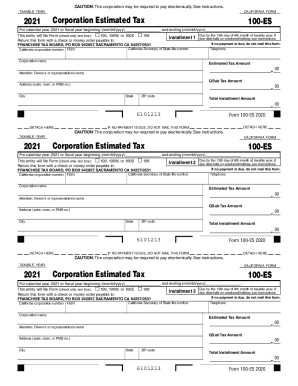

Get Ca Ftb 100-es 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 100-ES online

The CA FTB 100-ES form is used for corporations to estimate their tax payments in California. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that you can efficiently fulfill your tax obligations.

Follow the steps to complete the form accurately and effectively.

- Click ‘Get Form’ button to access the form and display it in your preferred editor.

- Enter the taxable year at the top of the form. This should reflect the current calendar year or the fiscal year you are filing for.

- Indicate the type of entity by checking one of the provided boxes (100, 100W, 100S, or 109). Only select one option.

- Input the California corporation number and Federal Employer Identification Number (FEIN) in the designated fields.

- Fill in the corporation's name, telephone number, and address, ensuring that you provide complete information, including suite or room numbers if applicable.

- In the estimated tax amount section, specify the dollar amount you anticipate owing for each installment as instructed.

- Complete the QSub tax amount if applicable; otherwise, leave it blank.

- If you are filing for multiple installments, repeat the previous few steps for each installment, paying careful attention to due dates as specified.

- Review all filled fields to ensure accuracy, as incorrect information may lead to processing delays or issues.

- Save your changes, download the completed form, and if necessary, you may print or share it as needed.

Complete your CA FTB 100-ES form online today for an efficient tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Time to process your corporation or LLC formation varies by state with routine processing taking 4 - 6 weeks or even more in the slowest states. In states where it is available, Rush Processing will reduce the time to form your business to about 2 - 3 business days.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.