Loading

Get Wa Dor Combined Excise Tax Return 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WA DoR Combined Excise Tax Return online

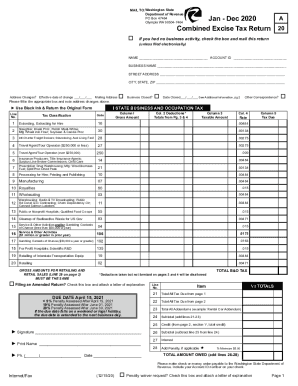

The WA Department of Revenue Combined Excise Tax Return is a necessary document for businesses operating in Washington State. This guide will help you understand each component of the form and provide step-by-step instructions on how to complete it online.

Follow the steps to complete your tax return online.

- Press the ‘Get Form’ button to retrieve the Combined Excise Tax Return form and open it for editing.

- Fill in your name, account ID, and business name in the designated fields at the top of the form. Ensure that the information is accurate and complete.

- Enter your street address, city, state, and ZIP code. If there have been any address changes, note the effective date of the change in the provided field.

- Indicate your tax classification and whether your business has closed. If applicable, provide the date closed in the provided field.

- In the Business and Occupation Tax section, input gross amounts, deductions, and calculate the taxable amounts as indicated for each category.

- Complete the Sales and Use Tax section. Ensure that you enter applicable rates and amounts for both state and local taxes.

- If applicable, complete the Other Taxes section by listing gross amounts and deductions for different tax classifications.

- Fill out the Credits section where applicable. Document each credit with its corresponding classification and amount.

- Review all entries for accuracy. This is crucial to avoid penalties and ensure a smooth filing process.

- Once all fields are completed, save your changes. You can also download, print, or share the form as necessary.

Complete your WA DoR Combined Excise Tax Return online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If you run service contracts on goods sold, or if you service tangible goods as part of your sales to customers, you may be liable to collect sales tax. ... Generally, tax is due on the entire amount charged for a taxable service, including items such as labor, materials and mileage charges, even if separately stated.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.